Page 60 - NIB Annual Report 12-13 | 13-14

P. 60

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2013

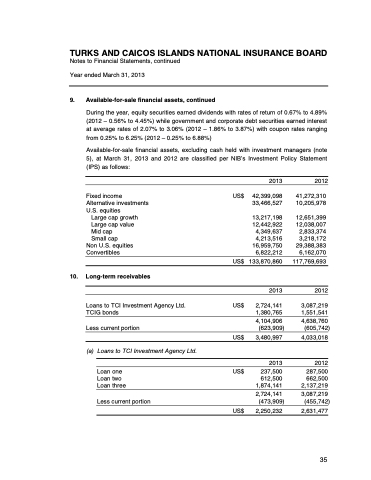

9. Available-for-sale financial assets, continued

During the year, equity securities earned dividends with rates of return of 0.67% to 4.89% (2012 – 0.56% to 4.45%) while government and corporate debt securities earned interest at average rates of 2.07% to 3.06% (2012 – 1.86% to 3.87%) with coupon rates ranging from 0.25% to 6.25% (2012 – 0.25% to 6.88%)

Available-for-sale financial assets, excluding cash held with investment managers (note 5), at March 31, 2013 and 2012 are classified per NIB’s Investment Policy Statement (IPS) as follows:

Fixed income Alternative investments U.S. equities

Large cap growth Large cap value Mid cap

Small cap

Non U.S. equities Convertibles

10. Long-term receivables

Loans to TCI Investment Agency Ltd. TCIG bonds

Less current portion

(a) Loans to TCI Investment Agency Ltd.

Loan one Loan two Loan three

Less current portion

US$

US$

US$ US$

US$

US$

2013

42,399,098 33,466,527

13,217,198 12,442,922 4,349,637 4,213,516 16,959,750 6,822,212

133,870,860

2013

2,724,141 1,380,765

4,104,906 (623,909)

3,480,997

2013

237,500

612,500 1,874,141

2,724,141 (473,909)

2,250,232

2012

41,272,310 10,205,978

12,651,399 12,038,007 2,833,374 3,218,172 29,388,383 6,162,070

117,769,693

2012

3,087,219 1,551,541

4,638,760 (605,742)

4,033,018

2012

287,500

662,500 2,137,219

3,087,219 (455,742)

2,631,477

56 | The National Insurance Board of The Turks and Caicos Islands

35