Page 62 - NIB Annual Report 12-13 | 13-14

P. 62

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2013

10. Long-term receivables, continued

(a) Loans to TCI Investment Agency Ltd., continued

(iii)

Loan three, continued

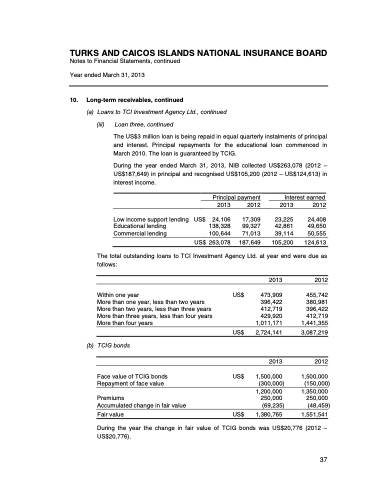

The US$3 million loan is being repaid in equal quarterly instalments of principal and interest. Principal repayments for the educational loan commenced in March 2010. The loan is guaranteed by TCIG.

During the year ended March 31, 2013, NIB collected US$263,078 (2012 – US$187,649) in principal and recognised US$105,200 (2012 – US$124,613) in interest income.

Principal payment

Interest earned

Low income support lending Educational lending Commercial lending

US$

2013

24,106 138,328 100,644

2012

17,309 99,327 71,013

2013

23,225 42,861 39,114

2012

24,408 49,650 50,555

US$ 263,078

105,200

Ltd. at year end were due as

187,649

124,613

The total outstanding loans to TCI Investment Agency follows:

Within one year

More than one year, less than two years More than two years, less than three years More than three years, less than four years More than four years

(b) TCIG bonds

Face value of TCIG bonds Repayment of face value

Premiums

Accumulated change in fair value

Fair value

US$ US$

US$

US$

2013

473,909 396,422 412,719 429,920

1,011,171 2,724,141

2013

1,500,000 (300,000)

1,200,000 250,000

(69,235) 1,380,765

2012

455,742 380,981 396,422 412,719

1,441,355 3,087,219

2012

1,500,000 (150,000)

1,350,000 250,000

(48,459) 1,551,541

During the year the change in fair value of TCIG bonds was US$20,776 (2012 – US$20,776).

58 | The National Insurance Board of The Turks and Caicos Islands

37