Page 74 - NIB Annual Report 12-13 | 13-14

P. 74

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2013

23. Retirement benefit obligations, continued

At March 31, 2013 the Plan had total assets of US$nil (2012 – US$4,068). During the year ended March 31, 2013 the remaining US$4,068 (2012 – US$1,345,583) of the Plan’s assets were distributed to its active members.

The present value of funded obligations at April 1, 2011 was calculated by an independent actuary using the Projected Unit Credit actuarial cost method. Under this method the present value of the deferred lifetime pension (with five years certain) based on years of service at the termination date and projected salary during the year prior to attaining age 60, starting from age 60, was estimated.

A member of the Plan was entitled to a retirement pension if they satisfied the following conditions:

they had completed not less than 15 years of pensionable service with NIB, of which at least 5 years were continuous prior to retirement; and

they had contributed to the Plan for a minimum period of 5 years.

The minimum retirement pension was equivalent to 25% of the member’s basic salary.

NIB determined that, in accordance with the terms and conditions of the defined benefit plan, and in accordance with minimum funding requirements of the Plan, the present value of refunds or reductions in future contributions was not lower than the balance of the total fair value of the Plan’s assets less the total present value of its obligations. As such, no decrease in the defined benefit asset was necessary at April 1, 2011.

NIB was obligated under the Trust Deed, which was made on April 1, 2004 between NIB and the board of trustees of the NIB Staff Complementary Pension Scheme (the Scheme), to contribute to the Plan to meet any shortfall. The Trust Deed governs the management of the Scheme.

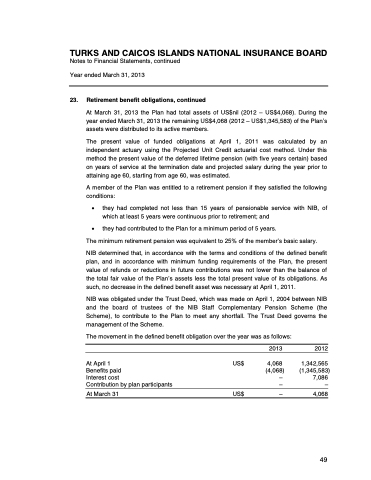

The movement in the defined benefit obligation over the year was as follows:

2013 2012

At April 1

Benefits paid

Interest cost

Contribution by plan participants

At March 31

US$ US$

4,068 1,342,565 (4,068) (1,345,583)

– 7,086 – –

– 4,068

70 | The National Insurance Board of The Turks and Caicos Islands

49