Page 83 - NIB Annual Report 12-13 | 13-14

P. 83

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2013

25. Financial instruments, continued

(a) Credit risk, continued

Based on past experience, NIB believes that no impairment allowance is necessary with respect to contributions receivable for less than 30 days. The majority of this balance includes amounts owed by NIB’s contributors who have a good payment record with NIB.

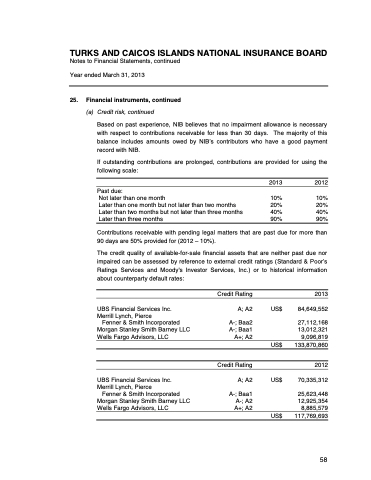

If outstanding contributions are prolonged, contributions are provided for using the following scale:

Past due:

Not later than one month

Later than one month but not later than two months Later than two months but not later than three months Later than three months

2013 2012

10% 10% 20% 20% 40% 40% 90% 90%

Contributions receivable with pending legal matters that are past due for more than 90 days are 50% provided for (2012 – 10%).

The credit quality of available-for-sale financial assets that are neither past due nor impaired can be assessed by reference to external credit ratings (Standard & Poor’s Ratings Services and Moody's Investor Services, Inc.) or to historical information about counterparty default rates:

UBS Financial Services Inc. Merrill Lynch, Pierce

Fenner & Smith Incorporated Morgan Stanley Smith Barney LLC Wells Fargo Advisors, LLC

UBS Financial Services Inc. Merrill Lynch, Pierce

Fenner & Smith Incorporated Morgan Stanley Smith Barney LLC Wells Fargo Advisors, LLC

Credit Rating A; A2 A-; Baa2

A-; Baa1 A+; A2

Credit Rating A; A2

A-; Baa1 A-; A2 A+; A2

US$ US$ US$ US$

2013

84,649,552

27,112,168 13,012,321 9,096,819 133,870,860

2012

70,335,312

25,623,448 12,925,354 8,885,579 117,769,693

2013 & 2014 ANNUAL REPORT | 79 58