Page 4 - UUBO PE Summit 2020 - Materials

P. 4

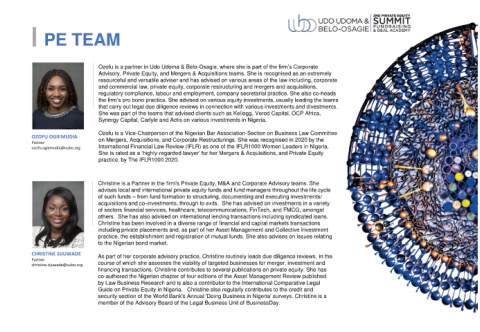

PE TEAM

Ozofu is a partner in Udo Udoma & Belo-Osagie, where she is part of the firm’s Corporate

Advisory, Private Equity, and Mergers & Acquisitions teams. She is recognised as an extremely

resourceful and versatile adviser and has advised on various areas of the law including, corporate

and commercial law, private equity, corporate restructuring and mergers and acquisitions,

regulatory compliance, labour and employment, company secretarial practice. She also co-heads

the firm’s pro bono practice. She advised on various equity investments, usually leading the teams

that carry out legal due diligence reviews in connection with various investments and divestments.

She was part of the teams that advised clients such as Kellogg, Verod Capital, OCP Africa,

Synergy Capital, Carlyle and Actis on various investments in Nigeria.

Ozofu is a Vice-Chairperson of the Nigerian Bar Association-Section on Business Law Committee

OZOFU OGIEMUDIA on Mergers, Acquisitions, and Corporate Restructurings. She was recognised in 2020 by the

Partner

ozofu.ogiemudia@uubo.org International Financial Law Review (IFLR) as one of the IFLR1000 Women Leaders in Nigeria.

She is rated as a ‘highly-regarded lawyer’ for her Mergers & Acquisitions, and Private Equity

practice, by The IFLR1000 2020.

Christine is a Partner in the firm's Private Equity, M&A and Corporate Advisory teams. She

advises local and international private equity funds and fund managers throughout the life cycle

of such funds – from fund formation to structuring, documenting and executing investments/

acquisitions and co-investments, through to exits. She has advised on investments in a variety

of sectors financial services, healthcare, telecommunications, FinTech, and FMCG, amongst

others. She has also advised on international lending transactions including syndicated loans.

Christine has been involved in a diverse range of financial and capital markets transactions

including private placements and, as part of her Asset Management and Collective Investment

practice, the establishment and registration of mutual funds. She also advises on issues relating

to the Nigerian bond market.

CHRISTINE SIJUWADE As part of her corporate advisory practice, Christine routinely leads due diligence reviews, in the

Partner

christine.sijuwade@uubo.org course of which she assesses the viability of targeted businesses for merger, investment and

financing transactions. Christine contributes to several publications on private equity. She has

co-authored the Nigerian chapter of four editions of the Asset Management Review published

by Law Business Research and is also a contributor to the International Comparative Legal

Guide on Private Equity in Nigeria. Christine also regularly contributes to the credit and

security section of the World Bank's Annual 'Doing Business in Nigeria' surveys. Christine is a

member of the Advisory Board of the Legal Business Unit of BusinessDay.

5