Page 107 - Demo

P. 107

STATUTORY REPORTS

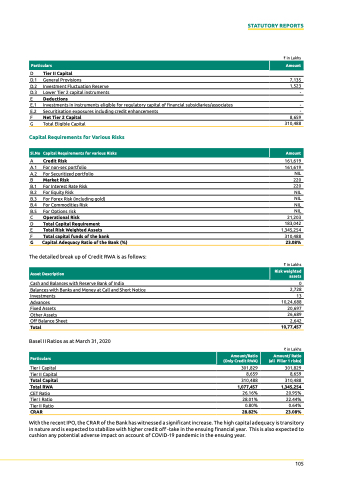

Particulars

amount

D tier ii capital

D.1 General Provisions

D.2 Investment Fluctuation Reserve

D.3 Lower Tier 2 capital instruments

E deductions

E.1 Investments in instruments eligible for regulatory capital of financial subsidiaries/associates

E.2 Securitisation exposures including credit enhancements

F net tier 2 capital

G Total Eligible Capital

capital requirements for various risks

A credit risk

A.1 For non-sec portfolio

A.2 For Securitized portfolio

B Market risk

B.1 For Interest Rate Risk

B.2 For Equity Risk

B.3 For Forex Risk (including gold)

B.4 For Commodities Risk

B.5 For Options risk

C operational risk

D total capital requirement

E total risk Weighted assets

F total capital funds of the bank

g capital adequacy ratio of the bank (%)

The detailed break up of Credit RWA is as follows:

Cash and Balances with Reserve Bank of India

Balances with Banks and Money at Call and Short Notice Investments

Advances

Fixed Assets

Other Assets

off Balance Sheet

total

Basel II Ratios as at March 31, 2020

` in Lakhs

7,135 1,523 -

-

- 8,659 310,488

161,619 161,619 NIL 220 220 NIL NIL NIL NIL 21,203 183,042 1,345,254 310,488 23.08%

` in Lakhs

0 2,728 13 10,24,688 20,697 26,689 2,642 10,77,457

` in Lakhs

301,829

8,659

310,488

1,345,254

20.95%

22.44% 0.64% 23.08%

sl.no

capital requirements for various risks

amount

asset description

risk weighted assets

Particulars

amount/ratio (only credit rWa)

amount/ ratio (all Pillar 1 risks)

Tier I Capital

Tier II Capital

total capital

total rWa

CET Ratio

Tier I Ratio

Tier II Ratio

crar 28.82%

301,829

8,659

310,488

1,077,457

26.16%

28.01% 0.80%

With the recent Ipo, the CRAR of the Bank has witnessed a significant increase. the high capital adequacy is transitory in nature and is expected to stabilize with higher credit off -take in the ensuing financial year. this is also expected to cushion any potential adverse impact on account of COVID-19 pandemic in the ensuing year.

105