Page 108 - Demo

P. 108

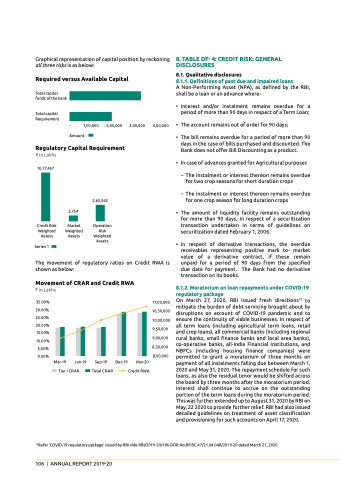

Graphical representation of capital position by reckoning all three risks is as below:

8. Table DF- 4: creDiT riSk: General discLosures

8.1. Qualitative disclosures

8.1.1. Definitions of past due and impaired loans

A non-performing Asset (npA), as defined by the RBI, shall be a loan or an advance where-

• Interest and/or instalment remains overdue for a period of more than 90 days in respect of a Term Loan;

• The account remains out of order for 90 days;

• The bill remains overdue for a period of more than 90 days in the case of bills purchased and discounted. The Bank does not offer Bill Discounting as a product.

• In case of advances granted for Agricultural purposes

− The instalment or interest thereon remains overdue for two crop seasons for short duration crops

− The instalment or interest thereon remains overdue for one crop season for long duration crops

• The amount of liquidity facility remains outstanding for more than 90 days, in respect of a securitization transaction undertaken in terms of guidelines on securitization dated February 1, 2006.

• In respect of derivative transactions, the overdue receivables representing positive mark to- market value of a derivative contract, if these remain unpaid for a period of 90 days from the specified due date for payment. The Bank had no derivative transaction on its books.

8.1.2. Moratorium on loan repayments under covid-19 regulatory package

On March 27, 2020, RBI issued fresh directions12 to mitigate the burden of debt servicing brought about by disruptions on account of COVID-19 pandemic and to ensure the continuity of viable businesses. In respect of all term loans (including agricultural term loans, retail and crop loans), all commercial banks (including regional rural banks, small finance banks and local area banks), co-operative banks, all-India Financial Institutions, and nBFCs (including housing finance companies) were permitted to grant a moratorium of three months on payment of all instalments falling due between March 1, 2020 and May 31, 2020. The repayment schedule for such loans, as also the residual tenor would be shifted across the board by three months after the moratorium period. Interest shall continue to accrue on the outstanding portion of the term loans during the moratorium period. This was further extended up to August 31, 2020 by RBI on May, 22 2020 to provide further relief. RBI had also issued detailed guidelines on treatment of asset classification and provisioning for such accounts on April 17, 2020.

required versus available capital

Total capital funds of the bank

Total capital Requirement

- 1,00,000 Amount

2,00,000

3,00,000

4,00,000

regulatory capital requirement

` in Lakhs 10,77,457

Credit Risk Weighted Assets

Series 1

2,754

Market Weighted Assets

2,65,042

Operation Risk Weighted Assets

The movement of regulatory ratios on Credit RWA is shown as below:

Movement of crar and credit rWa

` in Lakhs

35.00% 30.00% 25.00% 20.00% 15.00% 10.00%

5.00%

0.00%

Mar-19

11,00,000 10,50,000 10,00,000 9,50,000 9,00,000 8,50,000 8,00,000

Tier I CRAR

Jun-19

Sep-19

Total CRAR

Dec-19

Mar-20

Credit RWA

12Refer ‘COVID-19 regulatory package’ issued by RBI vide RBI/2019-20/186 DOR.No.BP.BC.47/21.04.048/2019-20 dated March 27, 2020.

106 | AnnuAl RepoRt 2019-20