Page 19 - Demo

P. 19

CORPORATE OVERVIEW

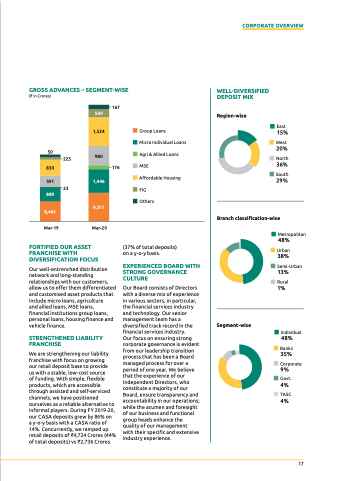

gROSS AdvANCES – SEgMENT-WISE

WELL-dIvERSIFIEd depoSit miX

(₹ in Crores)

50

23

167

176

Region-wise

549

1,524

980

225

Group Loans

Micro Individual Loans Agri & Allied Loans MSE

Affordable Housing FIG

Others

(37% of total deposits) on a y-o-y basis.

eXpeRienced BoaRd With StRonG GoveRnance cULtURe

Our Board consists of Directors with a diverse mix of experience in various sectors, in particular, the financial services industry and technology. Our senior management team has a diversified track record in the financial services industry.

Our focus on ensuring strong corporate governance is evident from our leadership transition process that has been a Board managed process for over a period of one year. We believe that the experience of our Independent Directors, who constitute a majority of our Board, ensure transparency and accountability in our operations; while the acumen and foresight of our business and functional group heads enhance the quality of our management

with their specific and extensive industry experience.

East

15%

West

20%

North

36%

South

29%

830

591

1,446

889

8,441

9,311

Branch classification-wise

Mar-19

Mar-20

FoRtiFied oUR aSSet FRanchiSe With diveRSiFication FocUS

Metropolitan

48%

Urban

38%

Semi-Urban

13%

Rural

1%

Individual

48%

Banks

35%

Corporate

9%

Govt.

4%

TASC

4%

Our well-entrenched distribution network and long-standing relationships with our customers, allow us to offer them differentiated and customised asset products that include micro loans, agriculture

and allied loans, MSE loans, financial institutions group loans, personal loans, housing finance and vehicle finance.

StRenGthened LiaBiLitY FRanchiSe

We are strengthening our liability franchise with focus on growing

our retail deposit base to provide

us with a stable, low-cost source

of funding. With simple, flexible products, which are accessible through assisted and self-serviced channels, we have positioned ourselves as a reliable alternative to informal players. During FY 2019-20, our CASA deposits grew by 86% on

a y-o-y basis with a CASA ratio of 14%. Concurrently, we ramped up retail deposits of ₹4,724 Crores (44% of total deposits) vs ₹2,736 Crores

Segment-wise

17