Page 251 - Demo

P. 251

Notes to financial statements

for the year ended March 31, 2020

3) Business is defined as total of average of gross advances and deposits (net of inter-bank deposits and Certificate of Deposits).

4) operating profit is net profit for the Year before provisions and contingencies and profit / (loss) on sale of building and other assets (net).

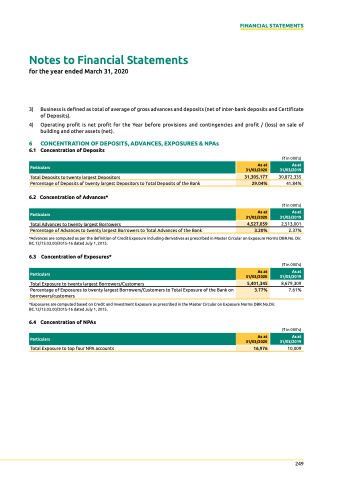

6 CONCeNTRATION Of dePOsITs, AdVANCes, eXPOsuRes & NPAs

6.1 Concentration of deposits

total Deposits to twenty largest Depositors

percentage of Deposits of twenty largest Depositors to total Deposits of the Bank

6.2 Concentration of Advances*

total Advances to twenty largest Borrowers

percentage of Advances to twenty largest Borrowers to total Advances of the Bank

(` in 000's)

30,872,335 41.84%

(` in 000's)

2,513,001 2.37%

Particulars

FINANCIAL STATEMENTS

Particulars

As at 31/03/2020

29.04%

As at 31/03/2019

31,305,177

As at 31/03/2020

As at 31/03/2019

4,527,059

3.20%

*Advances are computed as per the definition of Credit exposure including derivatives as prescribed in Master Circular on exposure norms DBR.no. Dir. BC.12/13.03.00/2015-16 dated July 1, 2015.

6.3 Concentration of exposures*

total exposure to twenty largest Borrowers/Customers

percentage of exposures to twenty largest Borrowers/Customers to total exposure of the Bank on borrowers/customers

*exposures are computed based on Credit and Investment exposure as prescribed in the Master Circular on exposure norms DBR.no.Dir. BC.12/13.03.00/2015-16 dated July 1, 2015.

6.4 Concentration of NPAs

total exposure to top four npA accounts

(` in 000's)

8,679,309 7.61%

(` in 000's)

10,009

Particulars

As at 31/03/2020

As at 31/03/2019

5,401,345

3.77%

Particulars

As at 31/03/2020

As at 31/03/2019

16,976

249