Page 253 - Demo

P. 253

Notes to financial statements

for the year ended March 31, 2020

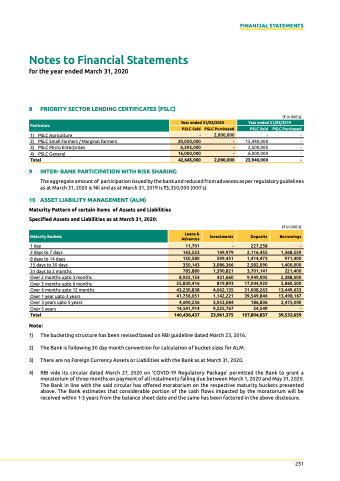

8 PRIORITy seCTOR LeNdINg CeRTIfICATes (PsLC)

1) pSlC Agriculture

2) pSlC Small Farmers / Marginal Farmers

3) pSlC Micro enterprises

4) pSlC General

(` in 000's)

- -

15,440,000 -

2,500,000 -

6,000,000 -

FINANCIAL STATEMENTS

Particulars

year ended 31/03/2020

Year ended 31/03/2019

pSLc Sold

pSLc purchased

PSLC Sold

PSLC Purchased

20,050,000

6,595,000

-

2,000,000

-

-

16,000,000

-

Total 23,940,000 -

9 INTeR- bANK PARTICIPATION WITh RIsK shARINg

the aggregate amount of participation issued by the bank and reduced from advances as per regulatory guidelines as at March 31, 2020 is nil and as at March 31, 2019 is `3,350,000 (000's).

42,645,000

2,000,000

10 AsseT LIAbILITy MANAgeMeNT (ALM)

Maturity pattern of certain items of Assets and Liabilities specified Assets and Liabilities as at March 31, 2020:

1 day

2 days to 7 days

8 days to 14 days

15 days to 30 days

31 days to 2 months

over 2 months upto 3 months over 3 months upto 6 months over 6 months upto 12 months over 1 year upto 3 years

over 3 years upto 5 years

over 5 years

Total

note:

1) the bucketing structure has been revised based on RBI guideline dated March 23, 2016.

2) the Bank is following 30 day month convention for calculation of bucket sizes for AlM.

3) there are no Foreign Currency Assets or liabilities with the Bank as at March 31, 2020.

(` in 000's)

Maturity Buckets

Loans & Advances

investments

deposits

borrowings

11,701

-

227,258

-

163,523

149,979

2,116,455

1,368,559

150,580

599,451

1,414,473

971,400

350,143

3,086,366

2,582,090

1,400,000

785,880

1,390,821

3,701,141

221,400

8,925,154

431,660

9,949,005

2,288,000

25,830,416

819,893

17,044,920

3,860,500

43,230,838

4,062,135

31,008,263

13,449,633

41,756,051

1,142,221

39,549,846

13,498,167

4,690,236

14,541,914

140,436,437

3,053,084

9,225,767

23,961,375

186,836

24,549

2,475,000

39,532,659

-

107,804,837

4) RBI vide its circular dated March 27, 2020 on 'CoVID-19 Regulatory package' permitted the Bank to grant a moratorium of three months on payment of all instalments falling due between March 1, 2020 and May 31, 2020. the Bank in line with the said circular has offered moratorium on the respective maturity buckets presented above. the Bank estimates that considerable portion of the cash flows impacted by the moratorium will be received within 1-3 years from the balance sheet date and the same has been factored in the above disclosure.

251