Page 254 - Demo

P. 254

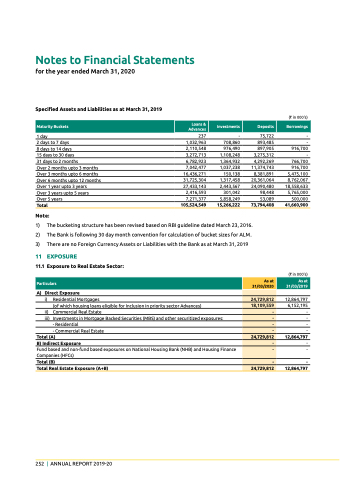

Notes to financial statements

for the year ended March 31, 2020

specified Assets and Liabilities as at March 31, 2019

1 day

2 days to 7 days

8 days to 14 days

15 days to 30 days

31 days to 2 months

over 2 months upto 3 months

over 3 months upto 6 months

over 6 months upto 12 months

over 1 year upto 3 years

over 3 years upto 5 years

over 5 years

237

1,032,963

2,110,548

3,272,713

6,782,923

7,042,477

16,436,271

31,725,304

27,433,143

2,416,593

7,271,377

-

708,860

976,490

1,108,248

1,364,932

1,037,238

150,138

1,317,458

2,443,567

301,042

5,858,249

15,266,222

75,722

893,485

897,905

3,275,312

4,292,269

11,374,743

8,381,891

20,361,064

24,090,480

98,448

53,089

73,794,408

(` in 000's)

-

-

916,700

-

766,700

916,700

5,475,100

8,762,067

18,558,633

5,765,000

500,000

41,660,900

(` in 000's)

12,864,797 6,152,195 - - - - 12,864,797 - -

- 12,864,797

Maturity Buckets

Loans & Advances

Investments

Deposits

Borrowings

Total 105,524,549

note:

1) the bucketing structure has been revised based on RBI guideline dated March 23, 2016.

2) the Bank is following 30 day month convention for calculation of bucket sizes for AlM.

3) there are no Foreign Currency Assets or liabilities with the Bank as at March 31, 2019

11 eXpoSURe

11.1 exposure to Real estate Sector:

A) direct exposure

i) Residential Mortgages

(of which housing loans eligible for Inclusion in priority sector Advances)

ii) Commercial Real estate

iii) Investments in Mortgage Backed Securities (MBS) and other securitized exposures:

- Residential

- Commercial Real estate

Total (A)

b) Indirect exposure

Fund based and non-fund based exposures on national Housing Bank (nHB) and Housing Finance Companies (HFCs)

Total (b)

Total Real estate exposure (A+b)

Particulars

As at 31/03/2020

As at 31/03/2019

24,729,812

252 | AnnuAl RepoRt 2019-20

18,109,559

-

-

-

-

24,729,812

-

-

-

24,729,812