Page 3 - Sample Employee Benefits Brochure - CONFIDENTIAL_Not For Distribution

P. 3

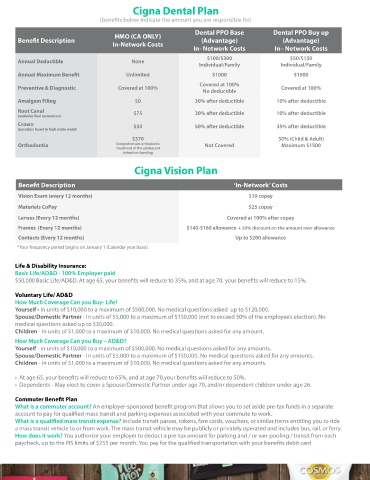

Medical Plan 1 Medical Plan 2 Cigna Dental Plan

Cigna PPO Base 3000 Amount Cigna PPO Buy Up 5000 Amount (bene ts below indicate the amount you are responsible for) Dental PPO Buy up

Dental PPO Base

You You Bene t Description HMO (CA ONLY) (Advantage) (Advantage)

Amount the Amount the

Bene t ‘In-Network’ Di erence Card Bene t ‘In-Network’ Di erence Card Pay In-Network Costs In- Network Costs In– Network Costs

Description Bene t Pay Description Bene t

Pays Pays $100/$300 $50/$150

Annual Deductible None

Annual Annual $250 Individual/Family Individual/Family

Deductible $3,000 $3,000 $0 Deductible $5,000 $4,750

Annual Maximum Bene t Unlimited $1000 $1500

In-Network 30% up to In-Network 20% up to 20% up to

Coinsurance $4,150 Up to $4,150 $0 Coinsurance $2,150 Up to $300 $1,850 Preventive & Diagnostic Covered at 100% Covered at 100% Covered at 100%

No deductible

Physician Visit Physician Visit

Copay $50 $50 $0 Copay $50 $40 $10 Amalgam Filing $0 30% after deductible 10% after deductible

Root Canal

Specialist Visit Specialist Visit (excludes nal restoration) $75 30% after deductible 10% after deductible

Copay $75 $65 $10 Copay $75 $40 $35

Crown $50 50% after deductible 35% after deductible

Emergency Emergency (porcelain fused to high noble metal)

Room Copay $500 $250 $250 Room Copay $500 $250 $250 $370 50% (Child & Adult)

Comprehensive orthodontic

Urgent Care Subject to Subject to Urgent Care Orthodontia treatment of the adolescent Not Covered Maximum $1500

Copay Deductible & Deductible & $50 Copay $50 n/a $50 detention-banding

Coinsurance

Coinsurance

Hospitalization Subject to Subject to Hospitalization Subject to Subject to

Copay Deductible & Deductible & $0 Copay Deductible & Deductible & $500/ admit Cigna Vision Plan

Coinsurance

Coinsurance

Coinsurance

Coinsurance

Preventative Covered at Covered at Preventative Covered at Covered at

Care 100% 100% Covered at 100% Care 100% 100% Covered at 100% Bene t Description ‘In-Network’ Costs

Prescription Drug $10/30/60 $15 each Prescription Drug $25/50/65 $20 Each $5/$30/$45 Vision Exam (every 12 months) $10 copay

Copay Tier 1/2/3 $0/$15/$45 Copay Tier 1/2/3

Materials CoPay $25 copay

Lenses (Every 12 months) Covered at 100% after copay

Frames (Every 12 months) $140-$160 allowance + 20% discount on the amount over allowance

Contacts (Every 12 months) Up to $200 allowance

The Di erence Card *Your frequency period begins on January 1 (Calendar year basis)

What is the Di erence Card and how does it work? Life & Disability Insurance:

Basic Life/AD&D - 100% Employer paid

The Di erence Card is a medical reimbursement program that integrates with SnackNation’s healthcare plans to help pay for some of $50,000 Basic Life/AD&D. At age 65, your bene ts will reduce to 35%, and at age 70, your bene ts will reduce to 15%.

the out-of-pocket expenses associated with using the healthcare plan.

Voluntary Life/ AD&D

How do I qualify to receive the Di erence Card Bene ts? How Much Coverage Can you Buy- Life?

Yourself - In units of $10,000 to a maximum of $500,000. No medical questions asked up to $120,000.

The Di erence Card has the potential to save you thousands of dollars, and it’s simple to qualify. The Di erence Card bene t is available to Spouse/Domestic Partner - In units of $5,000 to a maximum of $150,000 (not to exceed 50% of the employee’s election). No

employees who participate in SnackNation’s Wellness program and complete a biometric screening during the plan year. See the medical plan medical questions asked up to $30,000.

tables above for details on the potential savings and be sure to contact Human Resources to nd out how to obtain a biometric screening. Children - In units of $1,000 to a maximum of $10,000. No medical questions asked for any amount.

How Much Coverage Can you Buy – AD&D?

Flexible Spending Accounts Yourself - in units of $10,000 to a maximum of $500,000. No medical questions asked for any amounts.

Spouse/Domestic Partner - In units of $5,000 to a maximum of $150,000. No medical questions asked for any amounts.

Children - In units of $1,000 to a maximum of $10,000. No medical questions asked for any amounts.

Bene t-eligible employees may choose to contribute to SnackNation’s Flexible Spending Accounts (FSA). There are two types of FSAs:

• At age 65, your bene ts will reduce to 65%, and at age 70,your bene ts will reduce to 50%.

Healthcare FSA: • Dependents - May elect to cover a Spouse/Domestic Partner under age 70, and/or dependent children under age 26.

Allows you to redirect tax free dollars to pay for eligible medical and dental costs (up to $2,600 per person) for the 2017 calendar year.

Commuter Bene t Plan

Dependent Care FSA: What is a commuter account? An employer-sponsored bene t program that allows you to set aside pre-tax funds in a separate

Allows you to redirect tax free dollars to pay for eligible dependent care expenses (up to $5,000 per household) for the 2017 calendar year.

account to pay for quali ed mass transit and parking expenses associated with your commute to work.

What is a quali ed mass transit expense? Include transit passes, tokens, fare cards, vouchers, or similar items entitling you to ride

Note: FSA dollars not used during the plan year are forfeited if not used.

a mass transit vehicle to or from work. The mass transit vehicle may be publicly or privately operated and includes bus, rail, or ferry.

How does it work? You authorize your employer to deduct a pre-tax amount for parking and / or van-pooling / transit from each

paycheck, up to the IRS limits of $255 per month. You pay for the quali ed transportation with your bene ts debit card