Page 19 - Laurie Quatrella Sellers Guide 2024

P. 19

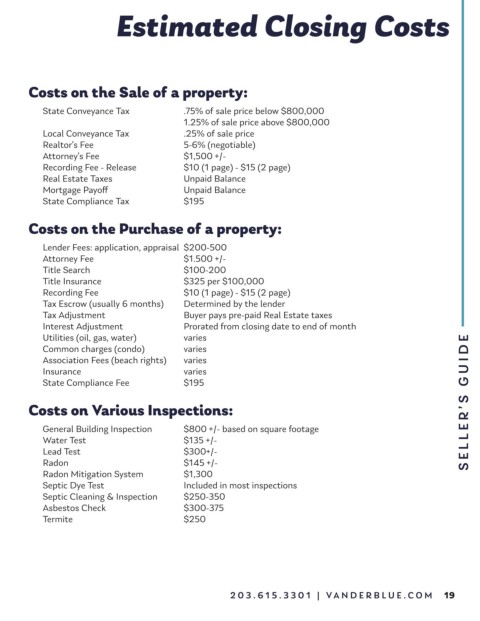

Estimated Closing Costs

Costs on the Sale of a property:

State Conveyance Tax .75% of sale price below $800,000

1.25% of sale price above $800,000

Local Conveyance Tax .25% of sale price

5-6% (negotiable)

Realtor’s Fee

Attorney’s Fee $1,500 +/-

Recording Fee - Release $10 (1 page) - $15 (2 page)

Real Estate Taxes Unpaid Balance

Mortgage Payo Unpaid Balance

State Compliance Tax $195

Costs on the Purchase of a property:

Lender Fees: application, appraisal $200-500

$1.500 +/-

Attorney Fee

Title Search

$100-200

Title Insurance $325 per $100,000

$10 (1 page) - $15 (2 page)

Recording Fee

Tax Escrow (usually 6 months) Determined by the lender

Tax Adjustment Buyer pays pre-paid Real Estate taxes

Interest Adjustment Prorated from closing date to end of month

Utilities (oil, gas, water) varies

Common charges (condo) varies

Association Fees (beach rights) varies

Insurance varies ’S GUIDE

State Compliance Fee $195

Costs on Various Inspections:

R

General Building Inspection $800 +/- based on square footage

Water Test LLE

$135 +/-

Lead Test $300+/-

Radon SE

$145 +/-

Radon Mitigation System $1,300

Septic Dye Test Included in most inspections

Septic Cleaning & Inspection $250-350

Asbestos Check $300-375

Termite $250

203.6 15 .3301 | VA N D E R B L U E . C O M 19