Page 19 - Laurie Quatrella Seller's Guide 2023

P. 19

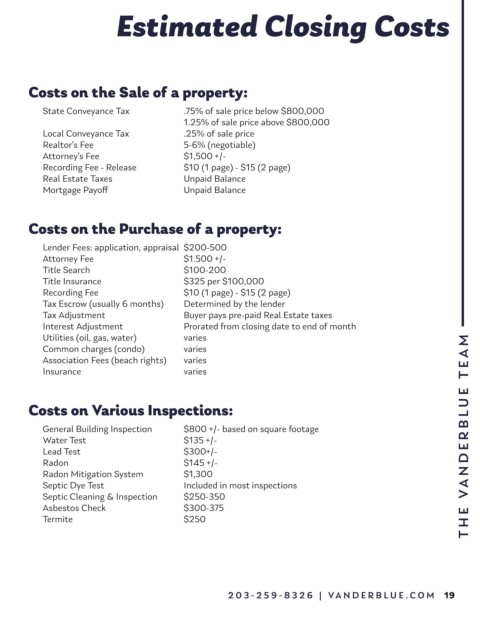

Estimated Closing Costs

Costs on the Sale of a property:

State Conveyance Tax .75% of sale price below $800,000

1.25% of sale price above $800,000

Local Conveyance Tax .25% of sale price

Realtor’s Fee 5-6% (negotiable)

Attorney’s Fee $1,500 +/-

Recording Fee - Release $10 (1 page) - $15 (2 page)

Real Estate Taxes Unpaid Balance

Mortgage Payoff Unpaid Balance

Costs on the Purchase of a property:

Lender Fees: application, appraisal $200-500

Attorney Fee $1.500 +/-

Title Search $100-200

Title Insurance $325 per $100,000

Recording Fee $10 (1 page) - $15 (2 page)

Tax Escrow (usually 6 months) Determined by the lender

Tax Adjustment Buyer pays pre-paid Real Estate taxes

Interest Adjustment Prorated from closing date to end of month

Utilities (oil, gas, water) varies M

Common charges (condo) varies

Association Fees (beach rights) varies

Insurance varies UE TEA

Costs on Various Inspections:

General Building Inspection $800 +/- based on square footage RBL

Water Test $135 +/-

Lead Test $300+/-

Radon $145 +/- NDE

Radon Mitigation System $1,300

Septic Dye Test Included in most inspections A

Septic Cleaning & Inspection $250-350

Asbestos Check $300-375

Termite $250 THE V

203-259-8 326 | VA N D E R B L U E . C O M 19