Page 23 - Sector Alarm Annual Report 2020

P. 23

Sector Alarm / Annual Report 2020

Capital and financing

Consolidated Interest-Bearing debt was NOK 6,465 million at the end of 2020 and consisted mainly of the EUR 590 million Term Loan B (NOK 6,177 billion) and NOK 355 million in financial leases. Cash and Cash equiv- alents at the end of 2020 was NOK 610 million (including re- stricted cash of NOK 12 million), up from NOK 270 million at the end of 2019.

Consolidated net interest-bear- ing debt was NOK 5,947 million and the Net Debt Cover was 5.3x at the end 2020. The EUR 100 million Revolving Credit facility remains undrawn by Sector Alarm.

In February 2020, Sector Alarm successfully concluded a repric- ing of the EUR 590 million Term Loan B with the margin being reduced from 350 bps to 300 bps and was issued at par with a 0% floor. This represent an annual reduction in interest cost for Sector Alarm of about NOK 30 million.

Risk and risk management

A deliberate strategy and pro- cedure for risk mitigation will, over time, impact profitability in a positive way. The responsibility of governing bodies, manage- ment and employees is to be aware of the current environ- ment in which they operate, implement measures to mitigate risks, prepare to act upon un- usual observations, threats

or incidents, and proactively try to reduce potential negative consequences.

Financial risks

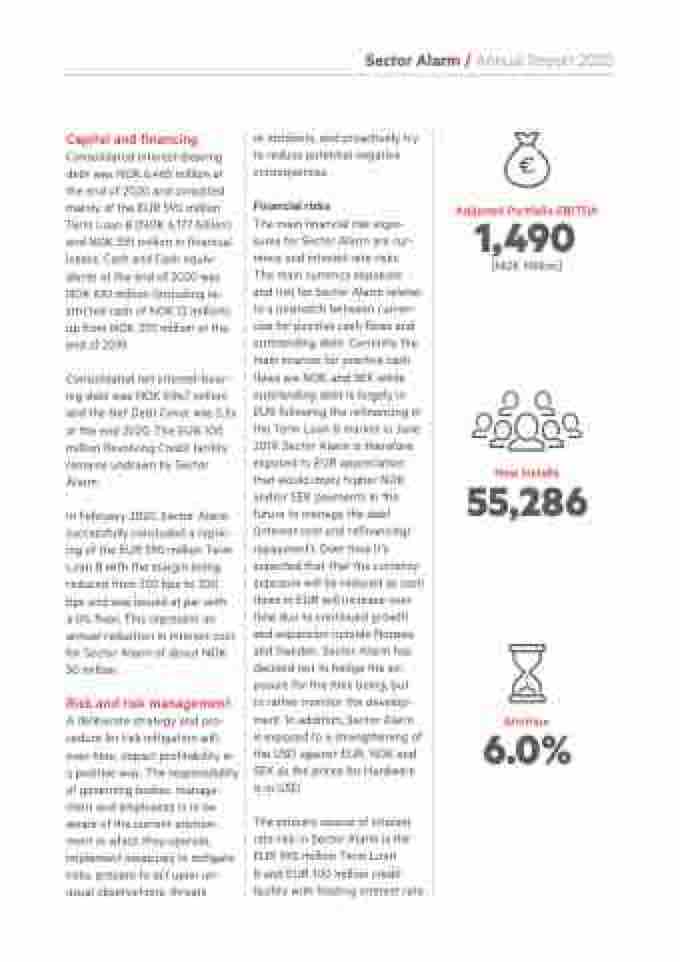

Adjusted Portfolio EBITDA

The main financial risk expo- sures for Sector Alarm are cur- rency and interest rate risks. The main currency exposure and risk for Sector Alarm relates to a mismatch between curren- cies for positive cash flows and outstanding debt. Currently the main sources for positive cash flows are NOK and SEK while outstanding debt is largely in EUR following the refinancing in the Term Loan B market in June 2019. Sector Alarm is therefore exposed to EUR appreciation that would imply higher NOK and/or SEK payments in the future to manage the debt (interest cost and refinancing/ repayment). Over time it’s expected that that the currency exposure will be reduced as cash flows in EUR will increase over time due to continued growth and expansion outside Norway and Sweden. Sector Alarm has decided not to hedge the ex- posure for the time being, but

to rather monitor the develop- ment. In addition, Sector Alarm is exposed to a strengthening of the USD against EUR, NOK and SEK as the prices for Hardware is in USD.

The primary source of interest rate risk in Sector Alarm is the EUR 590 million Term Loan

B and EUR 100 million credit facility with floating interest rate.

1,490

[NOK Million]

New installs

55,286

Attrition

6.0%