Page 72 - Sector Alarm Annual Report 2020

P. 72

72/73

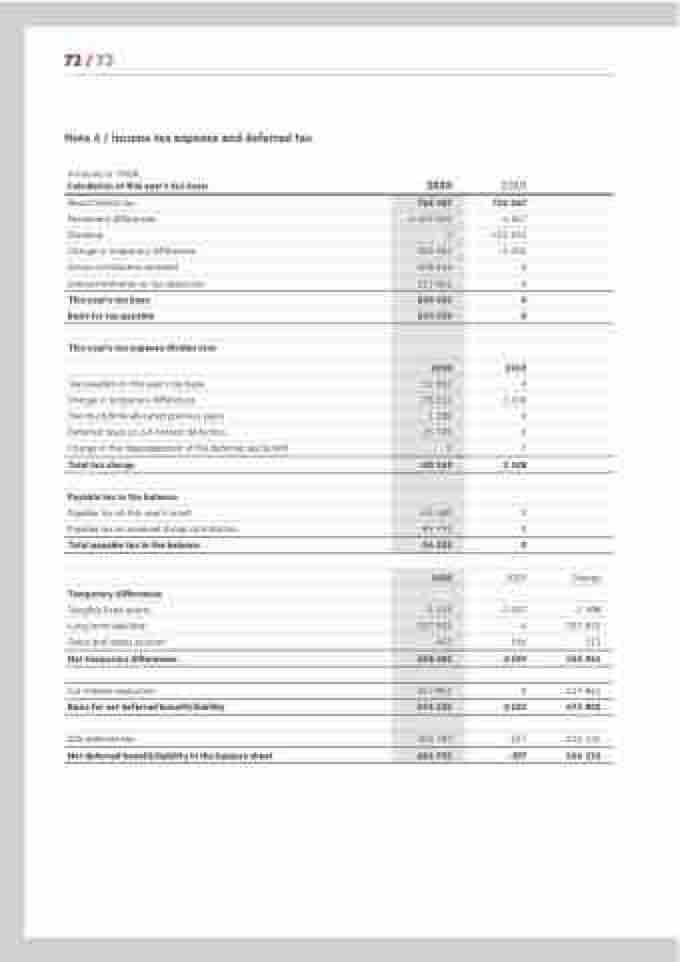

Note 4 / Income tax expense and deferred tax

Amounts in TNOK

Calculation of this year’s tax base:

Result before tax

Permanent differences

Dividend

Change in temporary differences Group contribution received Interest limitation on tax deduction This year's tax base

Basis for tax payable

This year's tax expense divides into:

Tax payable on this year's tax base

Change in temporary differences

Too much/little allocated previous years

Deferred taxes on cut interest deduction

Change in the disparagement of the deferred tax benefit Total tax charge

Payable tax in the balance:

Payable tax on this year's result

Payable tax on received Group contribution Total payable tax in the balance

Temporary differences

Tangible fixed assets

Long term liabilities

Gains and losses account Net temporary differences

Cut interest deduction

Basis for net deferred benefit/liability

22% deferred tax

Net deferred benefit/liability in the balance sheet

2020

2019

736 067

4 867

-735 932

-5 002

0

0

0

0

2019

0

1 100

0

0

7

1 108

0

0

0

2019 Change

765 487

-1 407 405

0

355 961

408 146

117 841

240 030

240 030

2020

52 807

-78 311

1 280

-25 925

0

-50 149

-35 480

89 792

54 312

2020

-1 109

-357 835

453

-358 491

-117 841

-476 332

-104 793

-104 793

-3 097

0

-1 988

357 835

566 113

-2 530

0

-2 530

-557

-557

355 961

117 841

473 802

104 236

104 236