Page 73 - Sector Alarm Annual Report 2020

P. 73

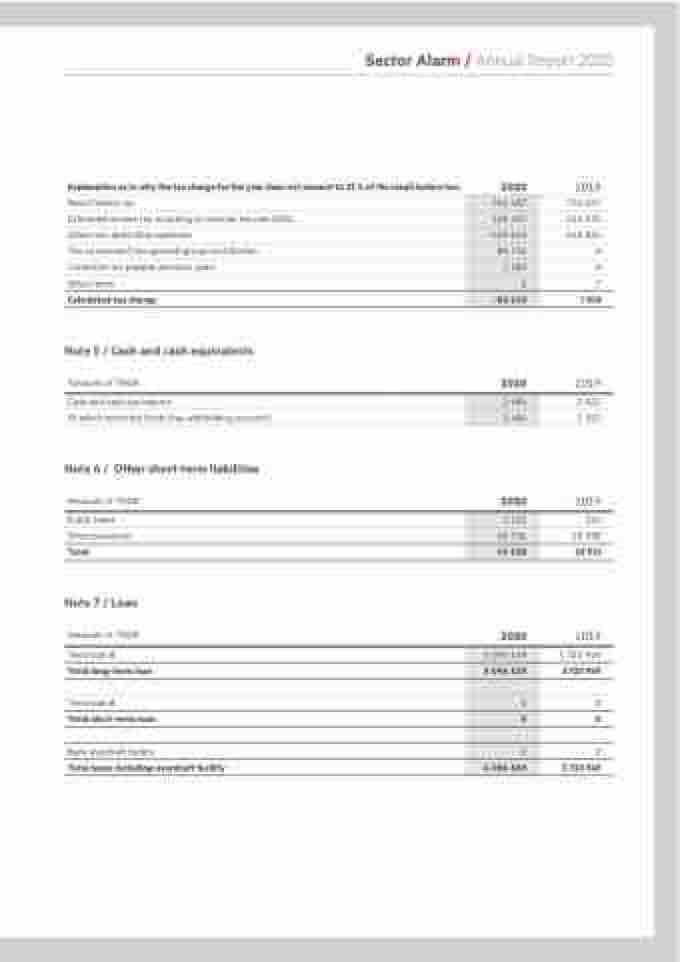

Explanation as to why the tax charge for the year does not amount to 22 % of the result before tax:

Result before tax

Estimated income tax according to nominal tax rate (22%) Other non-deductible expenses

Tax on received (recognized) group contribution Correction tax payable previous years

Other items

Calculated tax charge

Note 5 / Cash and cash equivalents Amounts in TNOK

Cash and cash equivalents

Of which restricted funds (tax withholding account):

Note 6 / Other short-term liabilities Amounts in TNOK

Public taxes

Other provisions

Total

Note 7 / Loan Amounts in TNOK

Term loan B

Total long-term loan

Term loan B

Total short-term loan

Bank overdraft facility

Total loans including overdraft facility

2020

2019

736 067

161 935 -160 834 0 0 7 1 108

2019

2 022 2 022

2019

324 28 588 28 912

2019

5 723 949

5 723 949

0

0

0

5 723 949

Sector Alarm / Annual Report 2020

765 487

168 407

-309 629

89 792

1 280

0

-50 149

2020

2020

2020

2 684

2 684

3 432

45 706

49 138

6 096 629

6 096 629

0

0

0

6 096 629