Page 51 - Intelligent Investing (3)

P. 51

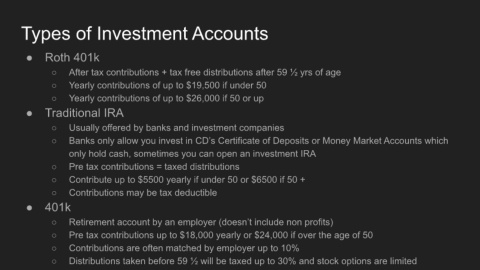

Types of Investment Accounts

● Roth 401k

○ After tax contributions + tax free distributions after 59 ½ yrs of age

○ Yearly contributions of up to $19,500 if under 50

○ Yearly contributions of up to $26,000 if 50 or up

● Traditional IRA

○ Usually offered by banks and investment companies

○ Banks only allow you invest in CD’s Certificate of Deposits or Money Market Accounts which

only hold cash, sometimes you can open an investment IRA

○ Pre tax contributions = taxed distributions

○ Contribute up to $5500 yearly if under 50 or $6500 if 50 +

○ Contributions may be tax deductible

● 401k

○ Retirement account by an employer (doesn’t include non profits)

○ Pre tax contributions up to $18,000 yearly or $24,000 if over the age of 50

○ Contributions are often matched by employer up to 10%

○ Distributions taken before 59 ½ will be taxed up to 30% and stock options are limited