Page 13 - RBL e book 16-07-2020.cdr

P. 13

~

Zero Allocation charges*

Tax Benefits

0

Bajaj Allianz Life Future Wealth Gain

IN THIS POLICY, THE INVESTMENT RISK IN INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER.

Draft. Not to be circulated.

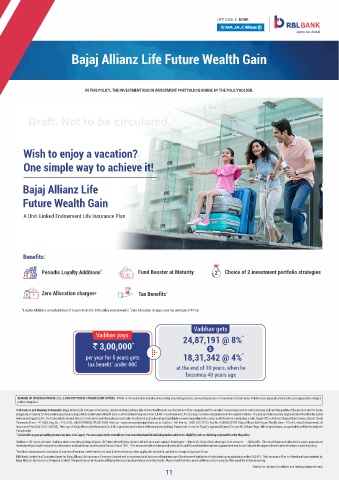

Wish to enjoy a vacation?

One simple way to achieve it!

Bajaj Allianz Life

Future Wealth Gain

A Unit-Linked Endowment Life Insurance Plan

Benefits:

WHY BAJAJ ALLIANZ LIFE FUTURE WEALTH GAIN? Periodic Loyalty Additions # Fund Booster at Maturity 2 Choice of 2 investment portfolio strategies

0 Zero Allocation charges* Tax Benefits ~

# *

Loyalty Additions at each interval of 5 years from the 10th policy year onwards | Zero Allocation charges over the premium of `3 lac

Getv gets

Vaibha

Vaibhav pays ^

24,87,191 @ 8%

+

`3,00,000

per year for 5 years gets 18,31,342 @ 4% ^

~

tax benefit under 80C

at the end of 10 years, when he

becomes 40 years age

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS / FRAUDULENT OFFERS - IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a

police complaint.

Risk Factors and Warning Statements: Bajaj Allianz Life Insurance Company Limited and Bajaj Allianz Life Future Wealth Gain are the names of the company and the product respectively and do not in any way indicate the quality of the product and its future

prospects or returns. Unlike traditional products, Bajaj Allianz Life Future Wealth Gain is a Unit Linked Insurance Plan (ULIP). Investment in ULIPs is subject to risks associated with the capital markets. The policy holder is solely responsible for his/her decisions

while investing in ULIPs. For more details on risk factors, terms and conditions please read sales brochure & policy document (available on www.bajajallianzlife.com) carefully before concluding a sale. Regd. Office Address: Bajaj Allianz House, Airport Road,

Yerawada, Pune - 411006, Reg.No.: 116 | CIN : U66010PN2001PLC015959 | Mail us : customercare@bajajallianz.co.in | Call on : Toll free no. 1800 209 7272 | Fax No: 02066026789 | Bajaj Allianz Life Future Wealth Gain - A Unit-Linked Endowment Life

Insurance Plan (UIN: 116L142V02), The Logo of Bajaj Allianz Life Insurance Co. Ltd. is provided on the basis of license given by Bajaj Finserv Ltd. to use its “Bajaj” Logo and Allianz SE to use its “Allianz” logo. All charges/ taxes, as applicable, will be borne by the

Policyholder.

~ Tax benefits as per prevailing Income tax laws shall apply. You are requested to consult your tax consultant and obtain independent advice for eligibility before claiming any benefit under the policy.

Vaibhav is 30-years old male. Vaibhav starts investing in Bajaj Allianz Life Future Wealth Gain. Variant: Wealth plus care variant | Fund name – Wheel of Life portfolio strategy | Sum assured – 30,00,000. The benefit amount indicated is a non-guaranteed

illustrative figure and is subject to policy terms and conditions and Goods & Service Tax of 18%. ^The assumed rate of returns indicated at 4% and 8% are illustrative and not guaranteed and do not indicate the upper or lower limits of returns under the policy.

+

Premium shown above is exclusive of any extra Premium, rider Premium, Goods & Service tax/any other applicable tax levied, subject to changes in tax laws if any.

RBL Bank Limited is a Corporate Agent for Bajaj Allianz Life Insurance Company Limited and is registered with Insurance Regulatory and Development Authority of India bearing registration number CA0116. This Insurance Plan is offered and underwritten by

Bajaj Allianz Life Insurance Company Limited. The purchase of an Insurance Plan by the customer is purely on voluntary basis. Please read the terms and conditions of an Insurance Plan carefully before investing.

Strictly for internal circulation and training purposes only.

11

Draft.Not to be circulated ahead.