Page 56 - VIADA Directory 2020

P. 56

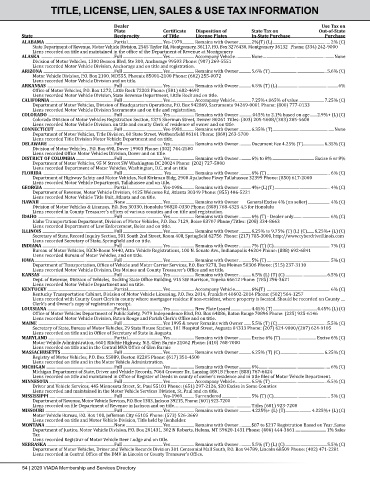

TITLE, LICENSE, LIEN, SALES & USE TAX INFORMATION

Dealer Use Tax on

Plate Certificate Disposition of State Tax on Out-of-State

State Reciprocity of Title License Plates In-State Purchase Purchase

ALABAMA .....................................................................Partial...................................Yes-1979 ............ Remains with Owner ............ 2%(T) (L) .......................................................... 2% (C)

State Department of Revenue, Motor Vehicle Division, 2545 Taylor Rd, Montgomery, 36117, P.O. Box 3276430, Montgomery 36132 Phone: (334) 242-9000

Liens recorded on title and maintained in the office of the Department of Revenue at Montgomery

ALASKA .........................................................................Full ........................................Yes ........................ Accompany Vehicle ................ None ........................................................................None

Division of Motor Vehicles, 1300 Benson Blvd, Ste 300, Anchorage 99503 Phone: (907) 269-5551

Liens recorded Motor Vehicle Division, Anchorage and on title and registration.

ARIZONA .......................................................................Full ........................................Yes ........................ Remains with Owner ............ 5.6% (T) .........................................................5.6% (C)

Motor Vehicle Division, P.O. Box 2100, MD555, Phoenix 85001-2100 Phone: (602) 255-0072

Liens recorded Motor Vehicle Division and on title.

ARKANSAS ...................................................................Full ........................................Yes ........................ Remains with Owner ............ 6.5% (T) (L) .............................................................6%

Office of Motor Vehicles, P.O. Box 1272, Little Rock 72203 Phone: (501) 682-4692

Liens recorded Motor Vehicle Division, State Revenue Department, Little Rock and on title.

CALIFORNIA ................................................................Full ........................................Yes ........................ Accompany Vehicle ................ 7.25%+.065% of value ..........................7.25% (C)

Department of Motor Vehicles, Division of Headquarters Operations, P.O. Box 942869, Sacramento 94269-0001 Phone: (800) 777-0133

Liens recorded Motor Vehicle Division Sacramento and on title and registration.

COLORADO ..................................................................Full ........................................Yes ........................ Remains with Owner ............ .045% to 2.1% based on age .......2.9%+ (L) (C)

Colorado Division of Motor Vehicles Registration Section, 1375 Sherman Street, Denver 80261 Titles: (303) 205-5608/(303) 205-5600

Liens recorded Motor Vehicle Division. on title and county Clerk of residence of owner and on title.

CONNECTICUT ...........................................................Full ........................................Yes-1981 ............ Remains with Owner ............ 6.35% (T) ..............................................................None

Department of Motor Vehicles, Title Division, 60 State Street, Wethersfield 06161 Phone: (860) 263-5700

Liens recorded Title Division Motor Vehicle Department and on title.

DELAWARE ..................................................................Full ........................................Yes ........................ Remains with Owner ............ Document Fee 4.25% (T) .....................6.35% (C)

Division of Motor Vehicles , P.O. Box 698, Dover 19903 Phone: (302) 744-2500

Liens recorded Office Motor Vehicles Division, Dover and on title.

DISTRICT OF COLUMBIA ......................................Full ........................................Yes ........................ Remains with Owner ............ 6% to 8% .......................................... Excise 6 or 8%

Department of Motor Vehicles, 95 M Street SW Washington DC 20024 Phone: (202) 727-5000

Liens recorded Department of Motor Vehicles, Washington, D.C. and on title

FLORIDA .......................................................................Full ........................................ Yes ....................... Remains with Owner ............ 6% (T) ................................................................ 6% (C)

Department of Highway Safety and Motor Vehicles, Neil Kirkman Bldg, 2900 Apalachee Pkwy Tallahassee 32399 Phone: (850) 617-2000

Liens recorded Motor Vehicle Department, Tallahassee and on title.

GEORGIA .......................................................................Partial...................................Yes-1986 ............ Remains with Owner ............ 4%+(L)(T) ........................................................ 4% (C)

Department of Revenue, Motor Vehicle Division, 4125 Welcome Rd, Atlanta 30349 Phone: (855) 406-5221

Liens recorded Motor Vehicle Title Unit, Atlanta and on title.

HAWAII ..........................................................................None .....................................Yes ........................ Remains with Owner General Excise 4% (on seller) ...................... 4% (C)

Division of Motor Vehicles & Licenses, P.O. Box 30330, Honolulu 96820-0330 Phone: (808) 768-4325 4.5 for Honolulu

Liens recorded in County Treasurer’s offices of various counties and on title and registration.

IDAHO ............................................................................Full ........................................Yes ........................ Remains with Owner ............ 6% (T) - Dealer only..................................... 6% (C)

Idaho Transportation Department, Division of Motor Vehicles, P.O. Box 7129, Boise 83707 Phone/Titles: (208) 334-8663

Liens recorded Department of Law Enforcement, Boise and on title.

ILLINOIS ........................................................................Full ........................................Yes ........................ Remains with Owner ............ 6.25% to 9.75% (T) (L) (C) .......6.25%+ (L) (C)

Secretary of State, Record Inquiry Section, 501 South 2nd Street, Room 408, Springfield 62756 Phone: (217) 785-3000, http://www.cyberdriveillinois.com

Liens recorded Secretary of State, Springfield and on title.

INDIANA ........................................................................Full ........................................Yes ........................ Remains with Owner ............ 7% (T) (C)......................................................... 7% (C)

Bureau of Motor Vehicles, IGCN-Room N440, Attn: Vehicle Registrations, 100 N. Senate Ave., Indianapolis 46204 Phone: (888) 692-6841

Liens recorded Bureau of Motor Vehicles, and on title.

IOWA ................................................................................Full ........................................Yes ........................ Remains with Owner ............ 5% (T) ................................................................ 5% (C)

Department of Transportation, Office of Vehicle and Motor Carrier Services, P.O. Box 9278, Des Moines 50306 Phone: (515) 237-3110

Liens recorded Motor Vehicle Division, Des Moines and County Treasurer’s Office and on title.

KANSAS .........................................................................Full ........................................Yes ........................ Remains with Owner ............ 6.5% (L) (T) (C) ..........................................6.5% (C)

Dept. of Revenue, Division of Vehicles, Docking State Office Building, 915 SW Harrison, Topeka 66612 Phone: (785) 296-3621

Liens recorded Motor Vehicle Department and on title.

KENTUCKY ...................................................................Partial...................................Yes ........................ Accompany Vehicle ................ 6%(T) ................................................................ 6% (C)

Kentucky Transportation Cabinet, Division of Motor Vehicle Licensing, P.O. Box 2014, Frankfort 40602-2014 Phone: (502) 564-1257

Liens recorded with County Court Clerk in county where mortgagor resides: if non-resident, where property is located. Should be recorded on County ....

Clerk’s and Owner’s copy of registration receipt.

LOUISIANA ...................................................................Partial...................................Yes ........................ New Plate Issued .................... 4.45% (T) .............................................4.45% (L) (C)

Office of Motor Vehicles Department of Public Safety, 7979 Independence Blvd, P.O. Box 64886, Baton Rouge 70896 Phone: (225) 925-6146

Liens recorded Motor Vehicle Division, Baton Rouge and Parish Clerk’s Office and on title.

MAINE ............................................................................Full ........................................Yes 1995 & newer Remains with Owner ....... 5.5% (T) (C) ..................................................5.5% (C)

Secretary of State, Bureau of Motor Vehicles, 29 State House Station, 101 Hospital Street, Augusta 04333 Phone: (207) 624-9000/(207) 624-9105

Liens recorded on title and in Office of Secretary of State in Augusta.

MARYLAND ..................................................................Partial...................................Yes ........................ Remains with Owner ............ Excise 6% (T) ....................................Excise 6% (C)

Motor Vehicle Administration, 6601 Ritchie Highway, N.E. Glen Burnie 21062 Phone: (410) 768-7000

Liens recorded on title and in the Central MVA Office of Glen Burnie

MASSACHUSETTS .....................................................Full ........................................Yes ........................ Remains with Owner ............ 6.25% (T) (C) ............................................6.25% (C)

Registry of Motor Vehicles, P.O. Box 55889, Boston 02205 Phone: (617) 351-4500

Liens recorded on title and in the Motor Vehicle Administration.

MICHIGAN ....................................................................Full ........................................Yes ........................ Remains with Owner ............ 6% ........................................................................ 6% (C)

Michigan Department of State, Driver and Vehicle Records, 7064 Crowner Dr., Lansing 48918 Phone: (888) 767-6424

Liens recorded on title and maintained in Office of Register of Deeds in county of owner’s residence and in title files of Motor Vehicle Department.

MINNESOTA .................................................................Full ........................................Yes ........................ Accompany Vehicle ................ 6.5% (T) .........................................................6.5% (C)

Driver and Vehicle Services, 445 Minnesota Street, St. Paul 55101 Phone: (651) 297-2126, $20 Excise in Some Counties

Liens recorded and maintained in the Motor Vehicle Services Division, St. Paul and on title.

MISSISSIPPI .................................................................Full ........................................Yes-1969 ............ Surrendered ............................. 5% (T) (C)......................................................... 5% (C)

Department of Revenue, Motor Vehicle Services, P.O. Box 1383, Jackson 39215, Phone: (601) 923-7200

Liens recorded on file-Department of Revenue in Jackson and on title. ............................................................................ Titles (601) 923-7200

MISSOURI .....................................................................Full ........................................Yes ........................ Remains with Owner ............ 4.225%+ (L) (T) ..........................4.225%+ (L) (C)

Motor Vehicle Bureau, P.O. Box 100, Jefferson City 65105 Phone: (573) 526-3669

Liens recorded on title and Motor Vehicle Division, Title held by lienholder.

MONTANA .....................................................................None .....................................Yes ........................ Remains with Owner ............ $87 to $217 Registration Based on Year .Same

Department of Justice, Motor Vehicle Division, P.O. Box 201431, 302 N Roberts, Helena, MT 59620-1431 Phone: (406) 444-3661 ...............................1% Sales

Tax

Liens recorded Registrar of Motor Vehicle Deer Lodge and on title.

NEBRASKA ...................................................................Full ........................................Yes ........................ Remains with Owner ............ 5.5% (T) (L) (C) ..........................................5.5% (C)

Department of Motor Vehicles, Driver and Vehicle Records Division 301 Centennial Mall South, P.O. Box 94789, Lincoln 68509 Phone: (402) 471-2281

Liens recorded in Central Office of the DMV in Lincoln or County Treasurer’s Office.

54 | 2020 VIADA Membership and Services Directory