Page 10 - EurOil Week 13 2021

P. 10

EurOil COMMENTARY EurOil

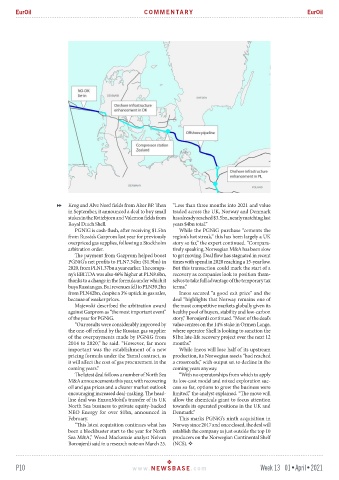

Krog and Alve Nord fields from Aker BP. Then “Less than three months into 2021 and value

in September, it announced a deal to buy small traded across the UK, Norway and Denmark

stakes in the Kvitebjorn and Valemon fields from has already reached $3.5bn, nearly matching last

Royal Dutch Shell. years $4bn total.”

PGNiG is cash-flush, after receiving $1.5bn While the PGNiG purchase “cements the

from Russia’s Gazprom last year for previously region’s hot streak,” this has been largely a UK

overpriced gas supplies, following a Stockholm story so far,” the expert continued. “Compara-

arbitration order. tively speaking, Norwegian M&A has been slow

The payment from Gazprom helped boost to get moving. Deal flow has stagnated in recent

PGNiG’s net profits to PLN7.34bn ($1.9bn) in times with spend in 2020 reaching a 15-year low.

2020, from PLN1.37bn a year earlier. The compa- But this transaction could mark the start of a

ny’s EBITDA was also 46% higher at PLN8.6bn, recovery as companies look to position them-

thanks to a change in the formula under which it selves to take full advantage of the temporary tax

buys Russian gas. But revenues fell to PLN39.2bn terms.”

from PLN42bn, despite a 3% uptick in gas sales, Ineos secured “a good exit price” and the

because of weaker prices. deal “highlights that Norway remains one of

Majewski described the arbitration award the most competitive markets globally given its

against Gazprom as “the most important event” healthy pool of buyers, stability and low-carbon

of the year for PGNiG. story,” Boroujerdi continued. “Most of the deal’s

“Our results were considerably improved by value centres on the 14% stake in Ormen Lange,

the one-off refund by the Russian gas supplier where operator Shell is looking to sanction the

of the overpayments made by PGNiG from $1bn late-life recovery project over the next 12

2014 to 2020,” he said. “However, far more months.”

important was the establishment of a new While Ineos will lose half of its upstream

pricing formula under the Yamal contract, as production, its Norwegian assets “had reached

it will affect the cost of gas procurement in the a crossroads,” with output set to decline in the

coming years.” coming years anyway.

The latest deal follows a number of North Sea “With no operatorships from which to apply

M&A announcements this year, with recovering its low-cost model and mixed exploration suc-

oil and gas prices and a clearer market outlook cess so far, options to grow the business were

encouraging increased deal-making. The head- limited,” the analyst explained. “The move will

line deal was ExxonMobil’s transfer of its UK allow the chemicals giant to focus attention

North Sea business to private equity-backed towards its operated positions in the UK and

NEO Energy for over $1bn, announced in Denmark.”

February. This marks PGNiG’s ninth acquisition in

“This latest acquisition continues what has Norway since 2017 and once closed, the deal will

been a blockbuster start to the year for North establish the company as just outside the top 10

Sea M&A,” Wood Mackenzie analyst Neivan producers on the Norwegian Continental Shelf

Boroujerdi said in a research note on March 25. (NCS).

P10 www. NEWSBASE .com Week 13 01•April•2021