Page 5 - EurOil Week 50 2020

P. 5

EurOil COMMENTARY EurOil

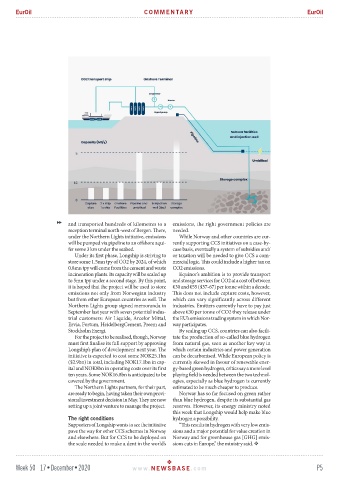

and transported hundreds of kilometres to a emissions, the right government policies are

reception terminal north-west of Bergen. There, needed.

under the Northern Lights initiative, emissions While Norway and other countries are cur-

will be pumped via pipeline to an offshore aqui- rently supporting CCS initiatives on a case-by-

fer some 3 km under the seabed. case basis, eventually a system of subsidies and/

Under its first phase, Longship is striving to or taxation will be needed to give CCS a com-

store some 1.5mn tpy of CO2 by 2024, of which mercial logic. This could include a higher tax on

0.8mn tpy will come from the cement and waste CO2 emissions.

incineration plants. Its capacity will be scaled up Equinor’s ambition is to provide transport

to 5mn tpy under a second stage. By this point, and storage services for CO2 at a cost of between

it is hoped that the project will be used to store €30 and €55 ($37-67) per tonne within a decade.

emissions not only from Norwegian industry This does not include capture costs, however,

but from other European countries as well. The which can vary significantly across different

Northern Lights group signed memoranda in industries. Emitters currently have to pay just

September last year with seven potential indus- above €30 per tonne of CO2 they release under

trial customers: Air Liquide, Arcelor Mittal, the EU’s emissions trading system in which Nor-

Ervia, Fortum, HeidelbergCement, Preem and way participates.

Stockholm Exergi. By scaling up CCS, countries can also facili-

For the project to be realised, though, Norway tate the production of so-called blue hydrogen

must first finalise its full support by approving from natural gas, seen as another key way in

Longship’s plan of development next year. The which certain industries and power generation

initiative is expected to cost some NOK25.1bn can be decarbonised. While European policy is

($2.9bn) in total, including NOK17.1bn in cap- currently skewed in favour of renewable ener-

ital and NOK8bn in operating costs over its first gy-based green hydrogen, critics say a more level

ten years. Some NOK16.8bn is anticipated to be playing field is needed between the two technol-

covered by the government. ogies, especially as blue hydrogen is currently

The Northern Lights partners, for their part, estimated to be much cheaper to produce.

are ready to begin, having taken their own provi- Norway has so far focused on green rather

sional investment decision in May. They are now than blue hydrogen, despite its substantial gas

setting up a joint venture to manage the project. reserves. However, its energy ministry noted

this week that Longship would help make blue

The right conditions hydrogen a possibility.

Supporters of Longship wants to see the initiative “This results in hydrogen with very low emis-

pave the way for other CCS schemes in Norway sions and a major potential for value creation in

and elsewhere. But for CCS to be deployed on Norway and for greenhouse gas [GHG] emis-

the scale needed to make a dent in the world’s sions cuts in Europe,” the ministry said.

Week 50 17•December•2020 www. NEWSBASE .com P5