Page 14 - Poland Outlook 2022

P. 14

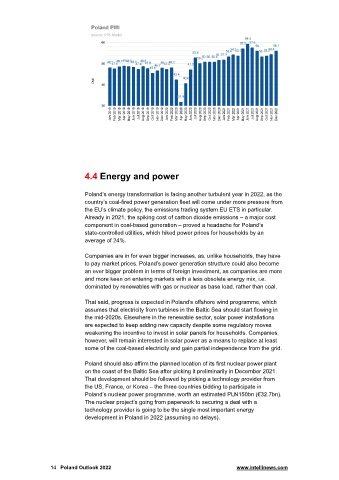

4.4 Energy and power

Poland’s energy transformation is facing another turbulent year in 2022, as the

country’s coal-fired power generation fleet will come under more pressure from

the EU’s climate policy, the emissions trading system EU ETS in particular.

Already in 2021, the spiking cost of carbon dioxide emissions – a major cost

component in coal-based generation – proved a headache for Poland’s

state-controlled utilities, which hiked power prices for households by an

average of 24%.

Companies are in for even bigger increases, as, unlike households, they have

to pay market prices. Poland’s power generation structure could also become

an ever bigger problem in terms of foreign investment, as companies are more

and more keen on entering markets with a less obsolete energy mix, i.e.

dominated by renewables with gas or nuclear as base load, rather than coal.

That said, progress is expected in Poland’s offshore wind programme, which

assumes that electricity from turbines in the Baltic Sea should start flowing in

the mid-2020s. Elsewhere in the renewable sector, solar power installations

are expected to keep adding new capacity despite some regulatory moves

weakening the incentive to invest in solar panels for households. Companies,

however, will remain interested in solar power as a means to replace at least

some of the coal-based electricity and gain partial independence from the grid.

Poland should also affirm the planned location of its first nuclear power plant

on the coast of the Baltic Sea after picking it preliminarily in December 2021.

That development should be followed by picking a technology provider from

the US, France, or Korea – the three countries bidding to participate in

Poland’s nuclear power programme, worth an estimated PLN150bn (€32.7bn).

The nuclear project’s going from paperwork to securing a deal with a

technology provider is going to be the single most important energy

development in Poland in 2022 (assuming no delays).

14 Poland Outlook 2022 www.intellinews.com