Page 4 - FSUOGM Week 47 2022

P. 4

FSUOGM COMMENTARY FSUOGM

EU releases symbolic gas and

preliminary oil cap price numbers

There are concerns that the proposed gas cap would be ineffectual.

RUSSIA THE European Commission has released the price is due to be confirmed by EU energy min-

prices for the proposed gas and preliminary oil isters at a meeting on November 24.

WHAT: price cap that will be confirmed in the coming “This price cap for gas is proposed for a year

The European days, but both are at a level that is more of a sym- in futures for a month ahead. Thus the EU tries

Commission has bolic gesture, rather than the crushing sanctions to avoid damaging the gas market, while in real-

proposed a €275/MWh many hoped would be announced. ity it costs Russia nothing to sell its gas via pipe-

price cap on front-month The West set the gas price cap for gas price line or as LNG at a profitable price. Now the price

gas contracts at the TTF futures traded on the Dutch TTF exchange at an of gas is at the level of €120 per MWh, or €1,298

hub. extremely high level of €275/MWh (€2,974 per per 1,000 cubic metres,” Denis Cenusa said in a

1,000 cubic metres). The EU has said it is seek- tweet. Cenusa is an academic at the East Europe

WHY: ing to prevent "greater damage to the economy" Studies Centre and bne IntelliNews contributor

Brussels is looking to of the EU. However, a caveat means the cap will who follows the energy story.

reduce the soaring cost only be triggered if this price level is breached for The oil price cap price has not been finalised

of gas. two consecutive weeks. but will be reportedly in the range of $60-$70

A second proposed trigger is the spread – again at a level that will probably not cost the

WHAT NEXT: between the TTF exchange price and the global Kremlin any money.

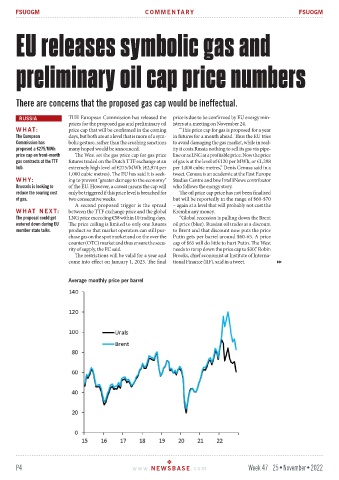

The proposal could get LNG price exceeding €58 within 10 trading days. “Global recession is pulling down the Brent

watered down during EU The price ceiling is limited to only one futures oil price (blue). Russian oil trades at a discount

member state talks. product so that market operators can still pur- to Brent and that discount now puts the price

chase gas on the spot market and on the over the Putin gets per barrel around $60-65. A price

counter (OTC) market and thus ensure the secu- cap of $65 will do little to hurt Putin. The West

rity of supply, the EC said. needs to ramp down the price cap to $30,” Robin

The restrictions will be valid for a year and Brooks, chief economist at Institute of Interna-

come into effect on January 1, 2023. The final tional Finance (IIF), said in a tweet.

Average monthly price per barrel

P4 www. NEWSBASE .com Week 47 25•November•2022