Page 7 - FSUOGM Week 14 2022

P. 7

FSUOGM COMMENTARY FSUOGM

will be extremely difficult to switch to another could go higher without ensuring Russian gas

source of energy and impossible to do so at short filling up Europe’s storage tanks ahead of this

notice. year’s heating season that starts in October.

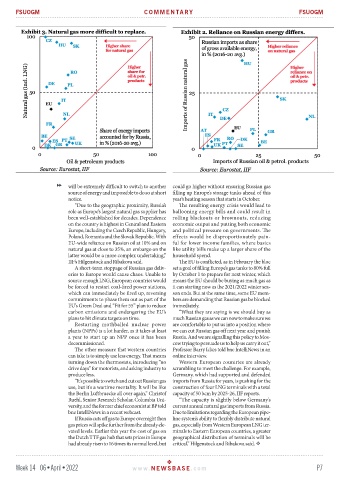

“Due to the geographic proximity, Russia’s The resulting energy crisis would lead to

role as Europe’s largest natural gas supplier has ballooning energy bills and could result in

been well-established for decades. Dependence rolling blackouts or brownouts, reducing

on the country is highest in Central and Eastern economic output and putting both economic

Europe, including the Czech Republic, Hungary, and political pressure on governments. The

Poland, Romania and the Slovak Republic. With effects would be disproportionately pain-

EU-wide reliance on Russian oil at 10% and on ful for lower income families, where basics

natural gas at close to 35%, an embargo on the like utility bills make up a larger share of the

latter would be a more complex undertaking,” household spend.

IIF’s Hilgenstock and Ribakova said. The EU is conflicted, as in February the bloc

A short-term stoppage of Russian gas deliv- set a goal of filling Europe’s gas tanks to 80% full

eries to Europe would cause chaos. Unable to by October 1 to prepare for next winter, which

source enough LNG, European countries would means the EU should be buying as much gas as

be forced to restart coal-fired power stations, it can starting now as the 2021/2022 winter sea-

which can immediately be fired up, reversing son ends. But at the same time, some EU mem-

commitments to phase them out as part of the bers are demanding that Russian gas be blocked

EU’s Green Deal and “Fit for 55” plan to reduce immediately.

carbon emissions and endangering the EU’s “What they are saying is we should buy as

plans to hit climate targets on time. much Russian gas as we can now to make sure we

Restarting mothballed nuclear power are comfortable to put us into a position where

plants (NPPs) is a lot harder, as it takes at least we can cut Russian gas off next year and punish

a year to start up an NPP once it has been Russia. And we are signalling this policy to Mos-

decommissioned. cow trying to persuade us to help us carry it out,”

The other measure that western countries Professor Barry Ickes told bne IntelliNews in an

can take is to simply use less energy. That means online interview.

turning down the thermostats, introducing “no Western European countries are already

drive days” for motorists, and asking industry to scrambling to meet the challenge. For example,

produce less. Germany, which had supported and defended

“It's possible to switch and cut out Russian gas imports from Russia for years, is pushing for the

use, but it's a wartime mentality. It will be like construction of four LNG terminals with a total

the Berlin Luftbruecke all over again,” Christof capacity of 50 bcm by 2025-26, IIF reports.

Ruehl, Senior Research Scholar, Columbia Uni- “The capacity is slightly below Germany’s

versity, and the former chief economist at BP told current annual natural gas imports from Russia.

bne IntelliNews in a recent webcast. Due to limitations regarding the European pipe-

If Russia cuts off gas to Europe overnight then line system’s ability to flexibly distribute natural

gas prices will spike further from the already ele- gas, especially from Western European LNG ter-

vated levels. Earlier this year the cost of gas on minals to Eastern European countries, a greater

the Dutch TTF gas hub that sets prices in Europe geographical distribution of terminals will be

had already risen to 16 times its normal level, but critical,” Hilgenstock and Ribakova said.

Week 14 06•April•2022 www. NEWSBASE .com P7