Page 5 - FSUOGM Week 06 2022

P. 5

FSUOGM COMMENTARY FSUOGM

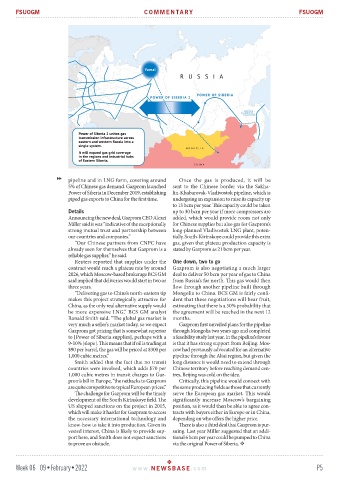

pipeline and in LNG form, covering around Once the gas is produced, it will be

5% of Chinese gas demand. Gazprom launched sent to the Chinese border via the Sakha-

Power of Siberia in December 2019, establishing lin-Khabarovsk-Vladivostok pipeline, which is

piped gas exports to China for the first time. undergoing an expansion to raise its capacity up

to 13 bcm per year. This capacity could be taken

Details up to 30 bcm per year if more compressors are

Announcing the new deal, Gazprom CEO Alexei added, which would provide room not only

Miller said it was “indicative of the exceptionally for Chinese supplies but also gas for Gazprom’s

strong mutual trust and partnership between long-planned Vladivostok LNG plant, poten-

our countries and companies.” tially. South-Kirinskoye could provide this extra

“Our Chinese partners from CNPC have gas, given that plateau production capacity is

already seen for themselves that Gazprom is a stated by Gazprom as 21 bcm per year.

reliable gas supplier,” he said.

Reuters reported that supplies under the One down, two to go

contract would reach a plateau rate by around Gazprom is also negotiating a much larger

2026, which Moscow-based brokerage BCS GM deal to deliver 50 bcm per year of gas to China

said implied that deliveries would start in two or from Russia’s far north. This gas would then

three years. flow through another pipeline built through

“Delivering gas to China’s north-eastern tip Mongolia to China. BCS GM is fairly confi-

makes this project strategically attractive for dent that these negotiations will bear fruit,

China, as the only real alternative supply would estimating that there is a 50% probability that

be more expensive LNG,” BCS GM analyst the agreement will be reached in the next 12

Ronald Smith said. “The global gas market is months.

very much a seller’s market today, so we expect Gazprom first unveiled plans for the pipeline

Gazprom got pricing that is somewhat superior through Mongolia two years ago and completed

to [Power of Siberia supplies], perhaps with a a feasibility study last year. In the pipeline’s favour

9-10% [slope]. This means that if oil is trading at is that it has strong support from Beijing. Mos-

$90 per barrel, the gas will be priced at $300 per cow had previously advocated for an alternative

1,000 cubic metres.” pipeline through the Altai region, but given the

Smith added that the fact that no transit long distance it would need to extend through

countries were involved, which adds $70 per Chinese territory before reaching demand cen-

1,000 cubic metres in transit charges to Gaz- tres, Beijing was cold on the idea.

prom’s bill in Europe, “the netbacks to Gazprom Critically, this pipeline would connect with

are quite competitive to typical European prices.” the same producing fields as those that currently

The challenge for Gazprom will be the timely serve the European gas market. This would

development of the South Kirinskoye field. The significantly increase Moscow’s bargaining

US slapped sanctions on the project in 2015, position, as it would then be able to agree con-

which will make it harder for Gazprom to access tracts with buyers either in Europe or in China,

the necessary international technology and depending on who offers the higher price.

know-how to take it into production. Given its There is also a third deal that Gazprom is pur-

vested interest, China is likely to provide sup- suing. Last year Miller suggested that an addi-

port here, and Smith does not expect sanctions tional 6 bcm per year could be pumped to China

to prove an obstacle. via the original Power of Siberia.

Week 06 09•February•2022 www. NEWSBASE .com P5