Page 6 - AsiaElec Week 41 2022

P. 6

AsiaElec COMMENTARY AsiaElec

Clearer ESG rules needed in

booming green bond market

THE global green bond market was worth for investors and portfolio managers. That key

COMMENTARY $552bn in 2021, accounting for 53% of all green, issue is the shortage of reliable and transparent

social and sustainability (GSS) issuances, accord- information that investors can rely on to conduct

ing to a recent report from Sustainable Fitch. ESG due diligence. Asset managers having to

2021 saw 69% growth in GSS bonds, also rely on non-standardised company disclosures.

termed labelled bonds, with 3,184 transactions There are different ESG standards on the

taking place, worth $1.02 trillion, Fitch said. market, promoted by varying bodies such as

Corporates represented the largest category of the EU, the UN, the ICMA, as well as diverging

issuers, claiming 36% of the market share, com- mandatory reporting rules, such as the SFDR,

pared with 26% in 2020. the CSRD and the TCFD, all with their own lev-

However, green bonds saw their share of the els of compulsion.

market dip in 2021 to 53% from their previous The EU’s SFDR, which it launched in March

dominant position, with KPI-linked bonds 2021, requires fund managers to provide infor-

showing the most dynamic growth of 9% in mation about the ESG risks and negative impact

2021. of their investment.

The growth is being driven by investor thirst For example, the EU’s green taxonomy is part

for sustainable investments, across all asset of its Action Plan on Sustainable Growth. This

classes, which has seen fixed income, especially aims to force larger companies to report how

GSS, issuance, creation and supply skyrocket to environmentally sustainable their activities are,

meet the demand. so investors can check their claims against per-

The market for GSS bonds, which are crucial formance. Brussels is also working on a Euro-

to investors meeting both their own and their cli- pean green bond standard.

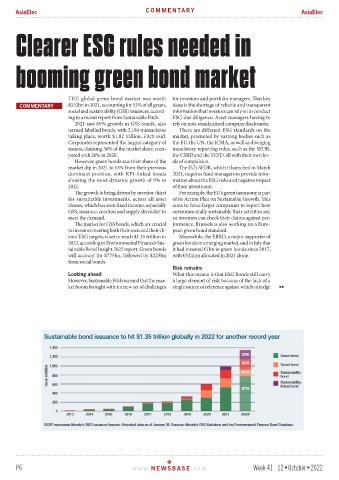

ents’ ESG targets, is set to reach $1.35 trillion in Meanwhile, the EBRD, a major supporter of

2022, according to Environmental Finance’s Sus- green bonds in emerging market, said in July that

tainable Bond Insight 2022 report. Green bonds it had invested €1bn in green bonds since 2017,

will account for $775bn, followed by $225bn with €524mn allocated in 2021 alone.

from social bonds.

Risk remains

Looking ahead What this means is that ESG bonds still carry

However, Sustainable Fitch warned that the mar- a large element of risk because of the lack of a

ket boom brought with it a new set of challenges single source of reference against which to judge

P6 www. NEWSBASE .com Week 41 12•October•2022