Page 5 - FSUOGM Week 48 2021

P. 5

FSUOGM COMMENTARY FSUOGM

place next year.

Gazprom acquired rights to Tambey in 2008

but has held off on its development while it has

focused on ramping up output at Bovanenkovo.

It had been expected that Gazprom would con-

tinue putting off development, but it suddenly

announced in May that it would push ahead, tar-

geting first gas in 2026. Even this schedule might

be brought forward in light of market conditions,

but that decision will depend on how long the

supply crunch and high prices in Europe are

sustained.

Gazprom also noted that its investment

programme would set aside some funds for

infrastructure improvements to carry Tambey’s

gas to the processing and liquefaction hub it is

developing with Rusgazdobycha on the shore of

the Baltic Sea. The field’s gas has a high concen-

tration of ethane, which is due to be separated

at the Baltic complex and used as feedstock for

petrochemicals.

Change in tact

It is likely that Gazprom will revise its 2022

investment programme upwards over the course

of next year, as is often the case with its spending

plans. Gazprom purposefully uses a conservative

gas price to base its investment plans on each

year, ensuring no overspend that might erode have seen an unprecedented surge this year, as

profit dispersals to the Russian government and global demand has rebounded in line with eco-

its other shareholders. In September the com- nomic recovery but supply has not risen to meet

pany raised its target for 2021 to RUB1.185 tril- it.

lion from 902bn that was originally approved in Gazprom’s Baltic gas complex will continue

December last year. to be a drain on the company’s capital resources

Gazprom has drawn criticism in the past for over the next few years, although the project

investing too much on ambitious projects, some- will help it fulfil its long-held goal of expanding

times with questionable economic rationale. LNG exports. The bigger question is whether

And analysts have blamed this for the compa- Gazprom’s far more ambitious plan to develop a

ny’s comparatively poor share performance over second gas pipeline to China through Mongolia

the years. will be realised.

The company’s spending levels soared in the Russian President Vladimir Putin announced

late 2010s as it invested in the costly construc- in mid-October that Moscow and Beijing had

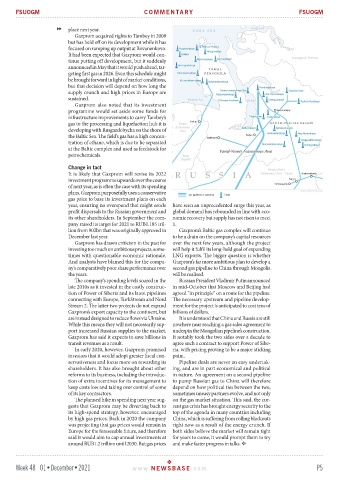

tion of Power of Siberia and its latest pipelines agreed “in principle” on a route for the pipeline.

connecting with Europe, TurkStream and Nord The necessary upstream and pipeline develop-

Stream 2. The latter two projects do not expand ment for the project is anticipated to cost tens of

Gazprom’s export capacity to the continent, but billions of dollars.

are instead designed to reduce flows via Ukraine. It is understood that China and Russia are still

While this means they will not necessarily sup- nowhere near reaching a gas sales agreement to

port increased Russian supplies to the market, underpin the Mongolian pipeline’s construction.

Gazprom has said it expects to save billions in It notably took the two sides over a decade to

transit revenues as a result. agree such a contract to support Power of Sibe-

In early 2020, however, Gazprom promised ria, with pricing proving to be a major sticking

investors that it would adopt greater fiscal con- point.

servativeness and focus more on rewarding its Pipeline deals are never an easy undertak-

shareholders. It has also brought about other ing, and are in part economical and political

reforms to its business, including the introduc- in nature. An agreement on a second pipeline

tion of extra incentives for its management to to pump Russian gas to China will therefore

keep costs low and taking over control of some depend on how political ties between the two,

of its key contractors. sometimes uneasy partners evolve, and not only

The planned hike in spending next year sug- on the gas market situation. This said, the cur-

gests that Gazprom may be diverting back to rent gas crisis has brought energy security to the

its high-spend strategy, however, encouraged top of the agenda in many countries including

by high gas prices. Back in 2020 the company China, which is suffering from rolling blackouts

was projecting that gas prices would remain in right now as a result of the energy crunch. If

Europe for the foreseeable future, and therefore both sides believe the market will remain tight

said it would aim to cap annual investments at for years to come, it would prompt them to try

around RUB1.2 trillion until 2030. But gas prices and make faster progress in talks.

Week 48 01•December•2021 www. NEWSBASE .com P5