Page 5 - DMEA Week 39 2021

P. 5

DMEA COMMENTARY DMEA

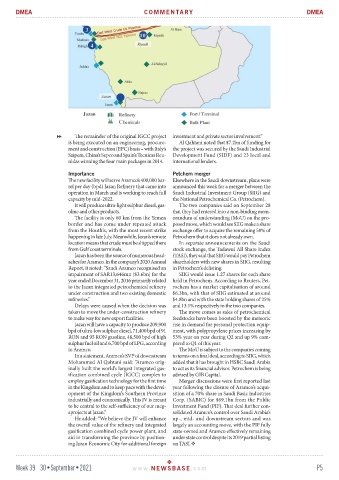

The remainder of the original IGCC project investment and private sector involvement.”

is being executed on an engineering, procure- Al Qahtani noted that $7.2bn of funding for

ment and construction (EPC) basis – with Italy’s the project was secured by the Saudi Industrial

Saipem, China’s Sepco and Spain’s Tecnicas Reu- Development Fund (SIDF) and 23 local and

nidas winning the four main packages in 2014. international lenders.

Importance Petchem merger

The new facility will serve Aramco’s 400,000 bar- Elsewhere in the Saudi downstream, plans were

rel per day (bpd) Jazan Refinery that came into announced this week for a merger between the

operation in March and is working to reach full Saudi Industrial Investment Group (SIIG) and

capacity by mid-2022. the National Petrochemical Co. (Petrochem).

It will produce ultra-light sulphur diesel, gas- The two companies said on September 28

oline and other products. that they had entered into a non-binding mem-

The facility is only 60 km from the Yemen orandum of understanding (MoU) on the pro-

border and has come under repeated attack posed move, which would see SIIG make a share

from the Houthis, with the most recent strike exchange offer to acquire the remaining 50% of

happening in late July. Meanwhile, Jazan’s remote Petrochem that it does not already own.

location means that crude must be shipped there In separate announcements on the Saudi

from Gulf coast terminals. stock exchange, the Tadawul All Share Index

Jazan has been the source of numerous head- (TASI), they said that SIIG would pay Petrochem

aches for Aramco. In the company’s 2020 Annual shareholders with new shares in SIIG, resulting

Report, it noted: “Saudi Aramco recognised an in Petrochem’s delisting.

impairment of SAR13,646mn [$3.6bn] for the SIIG would issue 1.27 shares for each share

year ended December 31, 2016 primarily related held in Petrochem. According to Reuters, Pet-

to the Jazan integrated petrochemical refinery rochem has a market capitalisation of around

under construction and two existing domestic $6.3bn, with that of SIIG estimated at around

refineries.” $4.8bn and with the state holding shares of 25%

Delays were caused when the decision was and 13.1% respectively in the two companies.

taken to move the under-construction refinery The move comes as sales of petrochemical

to make way for new export facilities. feedstocks have been boosted by the meteoric

Jazan will have a capacity to produce 209,900 rise in demand for personal protection equip-

bpd of ultra-low sulphur diesel, 71,400 bpd of 91 ment, with polypropylene prices increasing by

RON and 95 RON gasoline, 48,500 bpd of high 53% year on year during Q2 and up 9% com-

sulphur fuel oil and 6,700 bpd of LPG, according pared to Q1 of this year.

to Aramco. The MoU is subject to the companies coming

In a statement, Aramco’s SVP of downstream to terms on a final deal, according to SIIG, which

Mohammed Al Qahtani said: “Aramco orig- added that it has brought in HSBC Saudi Arabia

inally built the world’s largest integrated gas- to act as its financial advisor. Petrochem is being

ification combined cycle (IGCC) complex to advised by GIB Capital.

employ gasification technology for the first time Merger discussions were first reported last

in the Kingdom and to keep pace with the devel- year following the closure of Aramco’s acqui-

opment of the Kingdom’s Southern Province sition of a 70% share in Saudi Basic Industries

industrially and economically. This JV is meant Corp. (SABIC) for $69.1bn from the Public

to be central to the self-sufficiency of our meg- Investment Fund (PIF). That deal further con-

aprojects at Jazan.” solidated Aramco’s control over Saudi Arabia’s

He added: “We believe the JV will enhance up-, mid- and downstream sectors and was

the overall value of the refinery and integrated largely an accounting move, with the PIF fully

gasification combined cycle power plant, and state-owned and Aramco effectively remaining

aid in transforming the province by position- under state control despite its 2019 partial listing

ing Jazan Economic City for additional foreign on TASI.

Week 39 30•September•2021 www. NEWSBASE .com P5