Page 6 - AfrOil Week 40 2021

P. 6

AfrOil PIPELINES & TRANSPORT AfrOil

EACOP consortium reportedly close

to signing pipe supply agreements

TANZANIA/UGANDA THE consortium set up to build and operate in developing the Ugandan oilfields that will

the East Africa Crude Oil Pipeline (EACOP) is provide throughput for the pipeline.

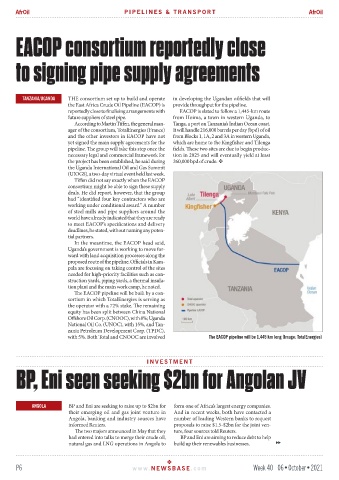

reportedly close to finalising arrangements with EACOP is slated to follow a 1,445-km route

future suppliers of steel pipe. from Hoima, a town in western Uganda, to

According to Martin Tiffen, the general man- Tanga, a port on Tanzania’s Indian Ocean coast.

ager of the consortium, TotalEnergies (France) It will handle 216,000 barrels per day (bpd) of oil

and the other investors in EACOP have not from Blocks 1, 1A, 2 and 3A in western Uganda,

yet signed the main supply agreements for the which are home to the Kingfisher and Tilenga

pipeline. The group will take this step once the fields. These two sites are due to begin produc-

necessary legal and commercial framework for tion in 2025 and will eventually yield at least

the project has been established, he said during 260,000 bpd of crude.

the Uganda International Oil and Gas Summit

(UIOGS), a two-day virtual event held last week.

Tiffen did not say exactly when the EACOP

consortium might be able to sign these supply

deals. He did report, however, that the group

had “identified four key contractors who are

working under conditional award.” A number

of steel mills and pipe suppliers around the

world have already indicated that they are ready

to meet EACOP’s specifications and delivery

deadlines, he stated, without naming any poten-

tial partners.

In the meantime, the EACOP head said,

Uganda’s government is working to move for-

ward with land acquisition processes along the

proposed route of the pipeline. Officials in Kam-

pala are focusing on taking control of the sites

needed for high-priority facilities such as con-

struction yards, piping yards, a thermal insula-

tion plant and the main work camp, he noted.

The EACOP pipeline will be built by a con-

sortium in which TotalEnergies is serving as

the operator with a 72% stake. The remaining

equity has been split between China National

Offshore Oil Corp. (CNOOC), with 8%; Uganda

National Oil Co. (UNOC), with 15%, and Tan-

zania Petroleum Development Corp. (TPDC),

with 5%. Both Total and CNOOC are involved The EACOP pipeline will be 1,445 km long (Image: TotalEnergies)

INVESTMENT

BP, Eni seen seeking $2bn for Angolan JV

ANGOLA BP and Eni are seeking to raise up to $2bn for form one of Africa’s largest energy companies.

their emerging oil and gas joint venture in And in recent weeks, both have contacted a

Angola, banking and industry sources have number of leading Western banks to request

informed Reuters. proposals to raise $1.5-$2bn for the joint ven-

The two majors announced in May that they ture, four sources told Reuters.

had entered into talks to merge their crude oil, BP and Eni are aiming to reduce debt to help

natural gas and LNG operations in Angola to build up their renewables businesses.

P6 www. NEWSBASE .com Week 40 06•October•2021