Page 12 - AfrOil Week 34 2021

P. 12

AfrOil PROJECTS & COMPANIES AfrOil

Once complete, the project is designed to $1.9bn project to install a hydrocracking com-

increase MIDOR’s product slate, more than plex at the 4.5mn tonne per year (tpy) EGPC-

doubling LPG output, nearly tripling jet fuel owned Assiut refinery in Upper Egypt.

production and raising high-octane gasoline The largest venture undertaken under this

and diesel by 60% and 45% respectively. programme was the $3.4bn, 140,000 bpd Mos-

MIDOR is majority-owned by Cairo’s Egyp- torod refinery, which was inaugurated in Sep-

tian General Petroleum Corp. (EGPC), along- tember last year. The facility was developed by

side local contractors ENPPI and Petrojet. a consortium led by private local firm Qalaa

Some $1.2bn of financing for the project was Holdings adjacent to the existing 145,000 bpd

provided by a consortium of banks that included government refinery on the outskirts of Cairo.

BNP Paribas, CDP Bank and Credit Agricole, In common with downstream projects

while the Italian Export Credit Agency (SACE) across the country, the scheme struggled to raise

and the Egyptian Ministry of Finance acted as finance even before the years of political and

guarantors. economic turmoil ushered in by the 2011 rev-

UK-based TechnipFMC was provisionally olution further derailed financiers’ confidence.

named as the EPC contractor back in 2015 but Italian export credit agency SACE helped fund

only signed the estimated $1.7bn deal in Octo- the MIDOR and Assiut projects.

ber 2018, shortly after belated financial close. However, both government finances and

The US’ UOP is supplying the technology. investor sentiment have substantially recovered

The expansion scheme is one of several over the past few years, while the resurgence of

greenfield and brownfield projects in train to the country’s upstream gas industry has created

boost national refining capacity and reduce bullishness throughout the energy sector.

costly imports of cleaner fuels. In late February 2019, Petroleum Minister

In 2018, TechnipFMC was given permission Tareq el-Molla declared a target of achieving

to proceed with early works on an estimated refined product self-sufficiency by 2022.

BW Energy finds oil in Hibiscus section

of Dussafu Marin block offshore Gabon

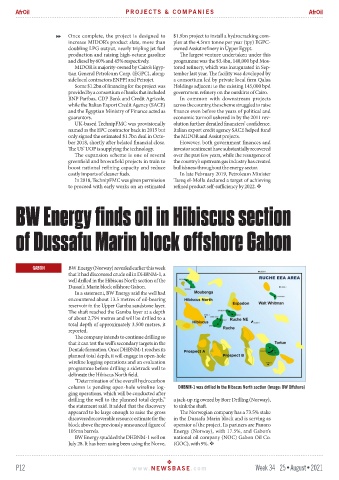

GABON BW Energy (Norway) revealed earlier this week

that it had discovered crude oil in DHBNM-1, a

well drilled in the Hibiscus North section of the

Dussafu Marin block offshore Gabon.

In a statement, BW Energy said the well had

encountered about 13.5 metres of oil-bearing

reservoir in the Upper Gamba sandstone layer.

The shaft reached the Gamba layer at a depth

of about 2,794 metres and will be drilled to a

total depth of approximately 3,500 metres, it

reported.

The company intends to continue drilling so

that it can test the well’s secondary targets in the

Dentale formation. Once DHBNM-1 reaches its

planned total depth, it will engage in open-hole

wireline logging operations and an evaluation

programme before drilling a sidetrack well to

delineate the Hibiscus North field.

“Determination of the overall hydrocarbon

column is pending open-hole wireline log- DHBNM-1 was drilled in the Hibscus North section (Image: BW Offshore)

ging operations, which will be conducted after

drilling the well to the planned total depth,” a jack-up rig owned by Borr Drilling (Norway),

the statement said. It added that the discovery to sink the shaft.

appeared to be large enough to raise the gross The Norwegian company has a 73.5% stake

discovered recoverable resource estimate for the in the Dussafu Marin block and is serving as

block above the previously announced figure of operator of the project. Its partners are Panoro

105mn barrels. Energy (Norway), with 17.5%, and Gabon’s

BW Energy spudded the DHBNM-1 well on national oil company (NOC) Gabon Oil Co.

July 28. It has been using been using the Norve, (GOC), with 9%.

P12 www. NEWSBASE .com Week 34 25•August•2021