Page 15 - LatAmOil Week 33

P. 15

LatAmOil BRAZIL LatAmOil

Total launches third phase of

Mero project offshore Brazil

FRANCE’S Total said last week that the consor- Production.

tium set up to develop the offshore Libra block The project “is in line with Total’s growth

had opted to move ahead with the third phase of strategy in Brazil’s deep-offshore, based on giant

work at the Mero field. projects enabling production at competitive

In a statement, Total said that the group cost, resilient in the face of oil price volatility,”

would use a floating production, storage and he added.

off-loading (FPSO) vessel for the project. The Total is targeting production of 150,000 bpd

Mero 3 FPSO will be able to handle 180,000 bar- in Brazil by 2025, Breuillac said. The company

rels per day (bpd) of liquids and is expected to has been present in the South American country

start up by 2024. for more than 40 years, and its Brazilian produc-

Total and the other companies involved tion averaged 16,000 bpd in 2019.

in the Libra project have already made invest- The French major’s Brazilian portfolio cur-

ment decisions for the first two phases of the rently includes 24 blocks, including 10 where it

Mero field. They expect the Mero 1 FPSO to serves as operator. Last October, a Total-led con-

begin operating in 2021 and the Mero 2 FPSO sortium was awarded Block C-M-541, located

to follow suit in 2023. Both platforms will have a in the pre-salt Campos Basin, in a state-run oil

capacity of 180,000 bpd, according to the French and gas bidding round. The consortium also

company’s statement. included Petrobras and Qatar Petroleum.

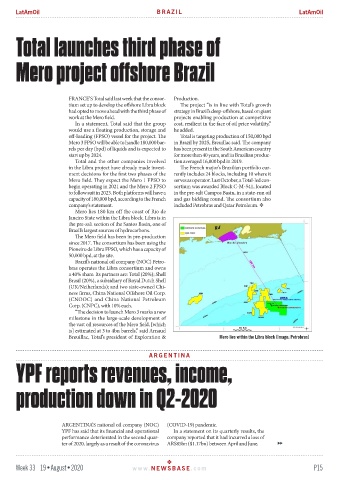

Mero lies 180 km off the coast of Rio de

Janeiro State within the Libra block. Libra is in

the pre-salt section of the Santos Basin, one of

Brazil’s largest sources of hydrocarbons.

The Mero field has been in pre-production

since 2017. The consortium has been using the

Pioneiro de Libra FPSO, which has a capacity of

50,000 bpd, at the site.

Brazil’s national oil company (NOC) Petro-

bras operates the Libra consortium and owns

a 40% share. Its partners are: Total (20%); Shell

Brasil (20%), a subsidiary of Royal Dutch Shell

(UK/Netherlands); and two state-owned Chi-

nese firms, China National Offshore Oil Corp.

(CNOOC) and China National Petroleum

Corp. (CNPC), with 10% each.

“The decision to launch Mero 3 marks a new

milestone in the large-scale development of

the vast oil resources of the Mero field, [which

is] estimated at 3 to 4bn barrels,” said Arnaud

Breuillac, Total’s president of Exploration & Mero lies within the Libra block (Image: Petrobras)

ARGENTINA

YPF reports revenues, income,

production down in Q2-2020

ARGENTINA’S national oil company (NOC) (COVID-19) pandemic.

YPF has said that its financial and operational In a statement on its quarterly results, the

performance deteriorated in the second quar- company reported that it had incurred a loss of

ter of 2020, largely as a result of the coronavirus ARS85bn ($1.17bn) between April and June.

Week 33 19•August•2020 www. NEWSBASE .com P15