Page 5 - FSUOGM Week 05 2022

P. 5

FSUOGM COMMENTARY FSUOGM

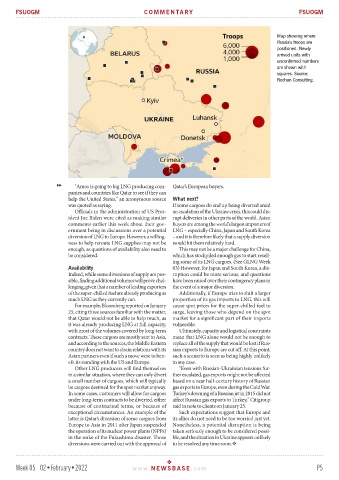

Map showing where

Russia's troops are

positioned. Newly

arrived units with

unconfirmed numbers

are shown with

squares. Source:

Rochan Consulting.

"Amos is going to big LNG producing com- Qatar’s European buyers.

panies and countries like Qatar to see if they can

help the United States," an anonymous source What next?

was quoted as saying. If some cargoes do end up being diverted amid

Officials in the administration of US Pres- an escalation of the Ukraine crisis, this could dis-

ident Joe Biden were cited as making similar rupt deliveries in other parts of the world. Asian

comments earlier this week about their gov- buyers are among the world’s largest importers of

ernment being in discussions over a potential LNG – especially China, Japan and South Korea

diversion of LNG to Europe. However, a willing- – and it is therefore likely that a supply diversion

ness to help reroute LNG supplies may not be would hit them relatively hard.

enough, as questions of availability also need to This may not be a major challenge for China,

be considered. which has stockpiled enough gas to start resell-

ing some of its LNG cargoes. (See GLNG Week

Availability 03) However, for Japan and South Korea, a dis-

Indeed, while some diversions of supply are pos- ruption could be more serious, and questions

sible, finding additional volumes will prove chal- have been raised over their contingency plans in

lenging, given that a number of leading exporters the event of a major diversion.

of the super-chilled fuel are already producing as Additionally, if Europe tries to shift a larger

much LNG as they currently can. proportion of its gas imports to LNG, this will

For example, Bloomberg reported on January cause spot prices for the super-chilled fuel to

25, citing three sources familiar with the matter, surge, leaving those who depend on the spot

that Qatar would not be able to help much, as market for a significant part of their imports

it was already producing LNG at full capacity, vulnerable.

with most of the volumes covered by long-term Ultimately, capacity and logistical constraints

contracts. These cargoes are mostly sent to Asia, mean that LNG alone would not be enough to

and according to the sources, the Middle Eastern replace all of the supply that would be lost if Rus-

country does not want to strain relations with its sian exports to Europe are cut off. At this point,

Asian partners even if such a move were to ben- such a scenario is seen as being highly unlikely

efit its standing with the US and Europe. in any case.

Other LNG producers will find themselves "Even with Russian-Ukrainian tensions fur-

in a similar situation, where they can only divert ther escalated, gas exports might not be affected

a small number of cargoes, which will typically based on a near half-century history of Russian

be cargoes destined for the spot market anyway. gas exports to Europe, even during the Cold War.

In some cases, customers will allow for cargoes Turkey's downing of a Russian jet in 2015 did not

under long-term contracts to be diverted, either affect Russian gas exports to Turkey," Citigroup

because of contractual terms, or because of said in note to clients on January 25.

exceptional circumstances. An example of the Such expectations suggest that Europe and

latter is Qatar’s diversion of some cargoes from its allies do not need to be too worried just yet.

Europe to Asia in 2011 after Japan suspended Nonetheless, a potential disruption is being

the operation of its nuclear power plants (NPPs) taken seriously enough to be considered possi-

in the wake of the Fukushima disaster. Those ble, and the situation in Ukraine appears unlikely

diversions were carried out with the approval of to be resolved any time soon.

Week 05 02•February•2022 www. NEWSBASE .com P5