Page 7 - AfrOil Week 36 2022

P. 7

AfrOil PIPELINES & TRANSPORT AfrOil

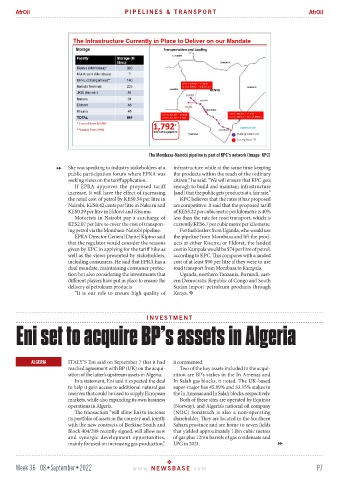

The Mombasa-Nairobi pipeline is part of KPC’s network (Image: KPC)

She was speaking to industry stakeholders at a infrastructure while at the same time keeping

public participation forum where EPRA was the products within the reach of the ordinary

seeking views on the tariff application. citizen,” he said. “We will ensure that KPC gets

If EPRA approves the proposed tariff enough to build and maintain infrastructure

increase, it will have the effect of increasing [and] that the public gets products at a fair rate.”

the retail cost of petrol by KES0.54 per litre in KPC believes that the rates it has proposed

Nairobi, KES0.42 cents per litre in Nakuru and are competitive. It said that the proposed tariff

KES0.29 per litre in Eldoret and Kisumu. of KES5.22 per cubic metre per kilometre is 40%

Motorists in Nairobi pay a surcharge of less than the rate for road transport, which is

KES2.07 per litre to cover the cost of transport- currently KES6.7 per cubic metre per kilometre.

ing petrol via the Mombasa-Nairobi pipeline. For fuel dealers from Uganda, who would use

EPRA Director General Daniel Kiptoo said the pipeline from Mombasa and lift the prod-

that the regulator would consider the reasons ucts at either Kisumu or Eldoret, the landed

given by KPC in applying for the tariff hike as cost in Kampala would be $74 per litre of petrol,

well as the views presented by stakeholders, according to KPC. This compares with a landed

including consumers. He said that EPRA has a cost of at least $90 per litre if they were to use

dual mandate, maintaining consumer protec- road transport from Mombasa to Kampala.

tion but also considering the investments that Uganda, northern Tanzania, Burundi, east-

different players have put in place to ensure the ern Democratic Republic of Congo and South

delivery of petroleum products Sudan import petroleum products through

“It is our role to ensure high quality of Kenya.

INVESTMENT

Eni set to acquire BP’s assets in Algeria

ALGERIA ITALY’S Eni said on September 7 that it had it commented.

reached agreement with BP (UK) on the acqui- Two of the key assets included in the acqui-

sition of the latter’s upstream assets in Algeria. sition are BP’s stakes in the In Amenas and

In a statement, Eni said it expected the deal In Salah gas blocks, it noted. The UK-based

to help it gain access to additional natural gas super-major has 45.89% and 33.15% stakes in

reserves that could be used to supply European the In Amenas and In Salah blocks, respectively.

markets, while also expanding its own business Both of these sites are operated by Equinor

operations in Algeria. (Norway), and Algeria’s national oil company

The transaction “will allow Eni to increase (NOC) Sonatrach is also a non-operating

its portfolio of assets in the country and, jointly shareholder. They are located in the Southern

with the new contracts of Berkine South and Sahara province and are home to seven fields

Block 404/208 recently signed, will allow new that yielded approximately 11bn cubic metres

and synergic development opportunities, of gas plus 12mn barrels of gas condensate and

mainly focused on increasing gas production,” LPG in 2021.

Week 36 08•September•2022 www. NEWSBASE .com P7