Page 13 - FSUOGM Week 35 2022

P. 13

FSUOGM POLICY FSUOGM

European gas storage tanks

reach 80% full target

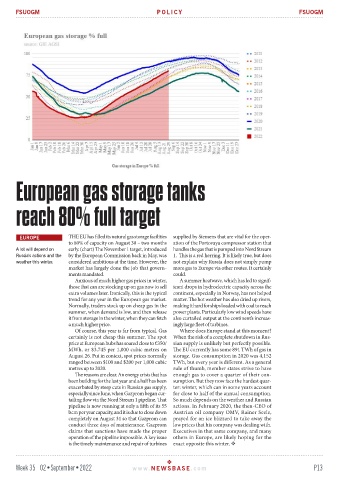

EUROPE THE EU has filled its natural gas storage facilities supplied by Siemens that are vital for the oper-

to 80% of capacity on August 30 – two months ation of the Portovaya compressor station that

A lot will depend on early. (chart) The November 1 target, introduced handles the gas that is pumped into Nord Stream

Russia's actions and the by the European Commission back in May, was 1. This is a red herring. It is likely true, but does

weather this winter. considered ambitious at the time. However, the not explain why Russia does not simply pump

market has largely done the job that govern- more gas to Europe via other routes. It certainly

ments mandated. could.

Anxious of much higher gas prices in winter, A summer heatwave, which has led to signif-

those that can are stocking up on gas now to sell icant drops in hydroelectric capacity across the

extra volumes later. Ironically, this is the typical continent, especially in Norway, has not helped

trend for any year in the European gas market. matter. The hot weather has also dried up rivers,

Normally, traders stock up on cheap gas in the making it hard for ships loaded with coal to reach

summer, when demand is low, and then release power plants. Particularly low wind speeds have

it from storage in the winter, when they can fetch also curtailed output at the continent’s increas-

a much higher price. ingly large fleet of turbines.

Of course, this year is far from typical. Gas Where does Europe stand at this moment?

certainly is not cheap this summer. The spot When the risk of a complete shutdown in Rus-

price at European hubs has soared close to €350/ sian supply is unlikely but perfectly possible.

MWh, or $3,745 per 1,000 cubic metres on The EU currently has some 891 TWh of gas in

August 26. Put in context, spot prices normally storage. Gas consumption in 2020 was 4,152

ranged between $100 and $200 per 1,000 cubic TWh, but every year is different. As a general

metres up to 2020. rule of thumb, member states strive to have

The reasons are clear. An energy crisis that has enough gas to cover a quarter of their con-

been building for the last year and a half has been sumption. But they now face the hardest quar-

exacerbated by steep cuts in Russian gas supply, ter: winter, which can in some years account

especially since June, when Gazprom began cur- for close to half of the annual consumption.

tailing flow via the Nord Stream 1 pipeline. That So much depends on the weather and Russian

pipeline is now running at only a fifth of its 55 actions. In February 2020, the then-CEO of

bcm per year capacity, and it is due to close down Austrian oil company OMV, Rainer Seele,

completely on August 31 so that Gazprom can prayed for an ice blizzard to take away the

conduct three days of maintenance. Gazprom low prices that his company was dealing with.

claims that sanctions have made the proper Executives in that same company, and many

operation of the pipeline impossible. A key issue others in Europe, are likely hoping for the

is the timely maintenance and repair of turbines exact opposite this winter.

Week 35 02•September•2022 www. NEWSBASE .com P13