Page 10 - FSUOGM Week 13 2021

P. 10

FSUOGM COMMENTARY FSUOGM

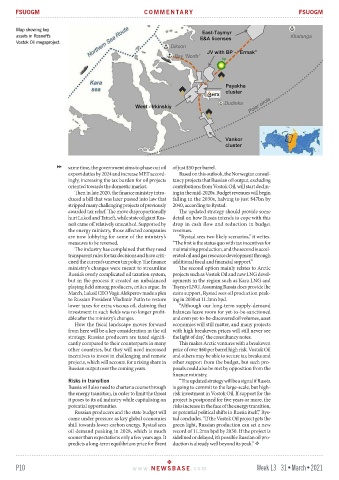

Map showing key

assets in Rosneft's

Vostok Oil megaproject.

same time, the government aims to phase out oil of just $50 per barrel.

export duties by 2024 and increase MET accord- Based on this outlook, the Norwegian consul-

ingly, increasing the tax burden for oil projects tancy projects that Russian oil output, excluding

oriented towards the domestic market. contributions from Vostok Oil, will start declin-

Then in late 2020, the finance ministry intro- ing in the mid-2020s. Budget revenues will begin

duced a bill that was later passed into law that falling in the 2030s, halving to just $47bn by

stripped many challenging projects of previously 2040, according to Rystad.

awarded tax relief. The move disproportionally The updated strategy should provide some

hurt Lukoil and Tatneft, while state oil giant Ros- detail on how Russia intends to cope with this

neft came off relatively unscathed. Supported by drop in cash flow and reduction in budget

the energy ministry, those affected companies revenues.

are now lobbying for some of the ministry’s “Rystad sees two likely scenarios,” it writes.

measures to be reversed. “The first is the status quo with tax incentives for

The industry has complained that they need maintaining production, and the second is accel-

transparent rules for tax decisions and have criti- erated oil and gas resource development through

cised the current’s uneven tax policy. The finance additional fiscal and financial support.”

ministry’s changes were meant to streamline The second option mainly relates to Arctic

Russia’s overly complicated oil taxation system, projects such as Vostok Oil and new LNG devel-

but in the process it created an unbalanced opments in the region such as Kara LNG and

playing field among producers, critics argue. In Taymyr LNG. Assuming Russia does provide the

March, Lukoil CEO Vagit Alekperov made a plea extra support, Rystad sees oil production peak-

to Russian President Vladimir Putin to restore ing in 2030 at 11.2mn bpd.

lower taxes for extra viscous oil, claiming that “Although our long-term supply-demand

investment in such fields was no longer profit- balances leave room for yet-to-be-sanctioned

able after the ministry’s changes. and even yet-to-be-discovered oil volumes, asset

How the fiscal landscape moves forward economies will still matter, and many projects

from here will be a key consideration in the oil with high breakeven prices will still never see

strategy. Russian producers are taxed signifi- the light of day,” the consultancy notes.

cantly compared to their counterparts in many This makes Arctic ventures with a breakeven

other countries, but they will need increased price of over $60 per barrel high risk. Vostok Oil

incentives to invest in challenging and remote and others may be able to secure tax breaks and

projects, which will account for a rising share in other support from the budget, but such pro-

Russian output over the coming years. posals could also be met by opposition from the

finance ministry.

Risks in transition “The updated strategy will be a signal if Russia

Russia will also need to charter a course through is going to commit to the large-scale, but high-

the energy transition, in order to limit the threat risk investment in Vostok Oil. If support for the

it poses to its oil industry while capitalising on project is postponed for five years or more, the

potential opportunities. risks increase in the face of the energy transition,

Russian producers and the state budget will or potential political shifts in Russia itself,” Rys-

come under pressure as key global economies tad concludes. “If the Vostok Oil project gets the

shift towards lower-carbon energy. Rystad sees green light, Russian production can set a new

oil demand peaking in 2028, which is much record of 11.2mn bpd by 2030. If the project is

sooner than expectations only a few years ago. It sidelined or delayed, it’s possible Russian oil pro-

predicts a long-term equilibrium price for Brent duction is already well beyond its peak.”

P10 www. NEWSBASE .com Week 13 31•March•2021