Page 108 - Russia OUTLOOK 2023

P. 108

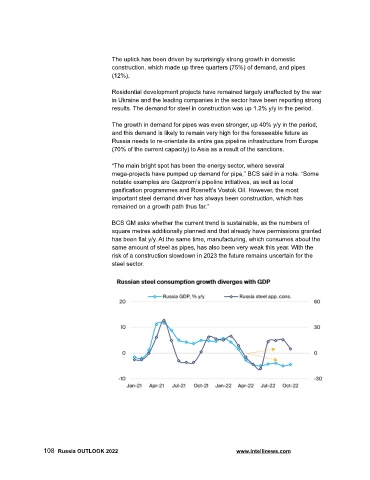

The uptick has been driven by surprisingly strong growth in domestic

construction, which made up three quarters (75%) of demand, and pipes

(12%).

Residential development projects have remained largely unaffected by the war

in Ukraine and the leading companies in the sector have been reporting strong

results. The demand for steel in construction was up 1.2% y/y in the period.

The growth in demand for pipes was even stronger, up 40% y/y in the period,

and this demand is likely to remain very high for the foreseeable future as

Russia needs to re-orientate its entire gas pipeline infrastructure from Europe

(70% of the current capacity) to Asia as a result of the sanctions.

“The main bright spot has been the energy sector, where several

mega-projects have pumped up demand for pipe,” BCS said in a note. “Some

notable examples are Gazprom’s pipeline initiatives, as well as local

gasification programmes and Rosneft’s Vostok Oil. However, the most

important steel demand driver has always been construction, which has

remained on a growth path thus far.”

BCS GM asks whether the current trend is sustainable, as the numbers of

square metres additionally planned and that already have permissions granted

has been flat y/y. At the same time, manufacturing, which consumes about the

same amount of steel as pipes, has also been very weak this year. With the

risk of a construction slowdown in 2023 the future remains uncertain for the

steel sector.

108 Russia OUTLOOK 2022 www.intellinews.com