Page 93 - Russia OUTLOOK 2023

P. 93

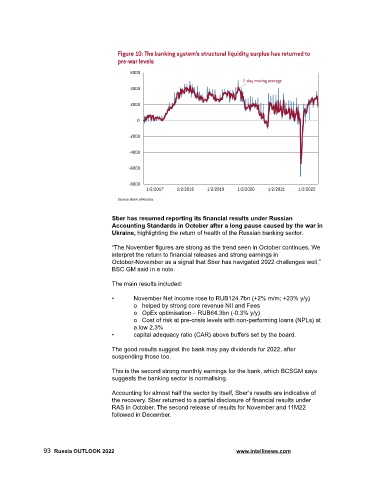

Sber has resumed reporting its financial results under Russian

Accounting Standards in October after a long pause caused by the war in

Ukraine, highlighting the return of health of the Russian banking sector.

“The November figures are strong as the trend seen in October continues. We

interpret the return to financial releases and strong earnings in

October-November as a signal that Sber has navigated 2022 challenges well,”

BSC GM said in a note.

The main results included:

• November Net income rose to RUB124.7bn (+2% m/m; +23% y/y)

o helped by strong core revenue NII and Fees

o OpEx optimisation – RUB64.3bn (-0.3% y/y)

o Cost of risk at pre-crisis levels with non-performing loans (NPLs) at

a low 2.3%

• capital adequacy ratio (CAR) above buffers set by the board.

The good results suggest the bank may pay dividends for 2022, after

suspending those too.

This is the second strong monthly earnings for the bank, which BCSGM says

suggests the banking sector is normalising.

Accounting for almost half the sector by itself, Sber’s results are indicative of

the recovery. Sber returned to a partial disclosure of financial results under

RAS in October. The second release of results for November and 11M22

followed in December.

93 Russia OUTLOOK 2022 www.intellinews.com