Page 5 - MEOG Week 45 2021

P. 5

MEOG COMMENTARY MEOG

$1.9 per barrel of oil produced from the asset – The MoO said it anticipates that the project

less than $1.2 per barrel after deduction of taxes with Chevron will achieve an initial target of

– under a 20-year technical services contract 600,000 bpd within seven years, though officials

(TSC) signed in 2010. speaking on condition of anonymity told MEOG

It is worth noting that the WQ-1 TSC also that the anticipated output level is in the range of

does not cover gas production, with China 250,000-600,000 bpd.

Petroleum Engineering & Construction Corp. One source said that the four exploration

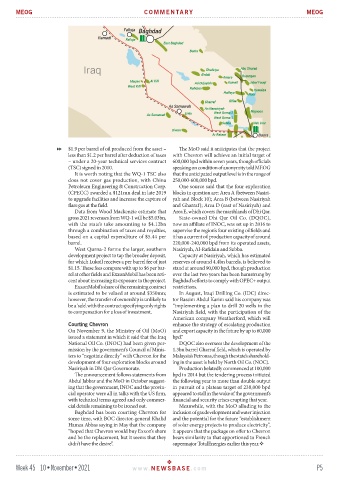

(CPECC) awarded a $121mn deal in late 2019 blocks in question are: Area A (between Nasiri-

to upgrade facilities and increase the capture of yah and Block 10); Area B (between Nasiriyah

flare gas at the field. and Gharraf); Area D (east of Nasiriyah) and

Data from Wood Mackenzie estimate that Area E, which covers the marshlands of Dhi Qar.

gross 2021 revenues from WQ-1 will be $5.03bn, State-owned Dhi Qar Oil Co. (DQOC),

with the state’s take amounting to $4.12bn now an affiliate of INOC, was set up in 2016 to

through a combination of taxes and royalties, supervise the region’s four existing oilfields and

based on a capital expenditure of $5.44 per it has a current oil production capacity of around

barrel. 220,000-240,000 bpd from its operated assets,

West Qurna-2 forms the larger, southern Nasiriyah, Al-Rafidain and Subba.

development project to tap the broader deposit, Capacity at Nasiriyah, which has estimated

for which Lukoil receives a per barrel fee of just reserves of around 4.4bn barrels, is believed to

$1.15. These fees compare with up to $6 per bar- stand at around 90,000 bpd, though production

rel at other fields and ExxonMobil has been reti- over the last two years has been hamstrung by

cent about increasing its exposure to the project. Baghdad’s efforts to comply with OPEC+ output

ExxonMobil’s share of the remaining contract restrictions.

is estimated to be valued at around $350mn; In August, Iraqi Drilling Co. (IDC) direc-

however, the transfer of ownership is unlikely to tor Bassim Abdul Karim said his company was

be a ‘sale’, with the contract specifying only rights “implementing a plan to drill 20 wells in the

to compensation for a loss of investment. Nasiriyah field, with the participation of the

American company Weatherford, which will

Courting Chevron enhance the strategy of escalating production

On November 9, the Ministry of Oil (MoO) and export capacity in the future by up to 60,000

issued a statement in which it said that the Iraq bpd.”

National Oil Co. (INOC) had been given per- DQOC also oversees the development of the

mission by the government’s Council of Minis- 1.3bn barrel Gharraf field, which is operated by

ters to “negotiate directly” with Chevron for the Malaysia’s Petronas, though the state’s sharehold-

development of four exploration blocks around ing in the asset is held by North Oil Co. (NOC).

Nasiriyah in Dhi Qar Governorate. Production belatedly commenced at 100,000

The announcement follows statements from bpd in 2014 but the tendering process initiated

Abdul Jabbar and the MoO in October suggest- the following year to more than double output

ing that the government, INOC and the provin- in pursuit of a plateau target of 230,000 bpd

cial operator were all in talks with the US firm, appeared to stall in the wake of the government’s

with technical terms agreed and only commer- financial and security crises erupting that year.

cial details remaining to be ironed out. Meanwhile, with the MoO alluding to the

Baghdad has been courting Chevron for inclusion of gas development and water injection

some time, with BOC director-general Khalid and the potential for the future “establishment

Hamza Abbas saying in May that the company of solar energy projects to produce electricity”,

“hoped that Chevron would buy Exxon’s share it appears that the package on offer to Chevron

and be the replacement, but it seems that they bears similarity to that apportioned to French

didn’t have the desire”. supermajor TotalEnergies earlier this year.

Week 45 10•November•2021 www. NEWSBASE .com P5