Page 18 - MEOG Week 13 2021

P. 18

MEOG PROJECTS & COMPANIES MEOG

Schlumberger wins

Iraqi drilling contract

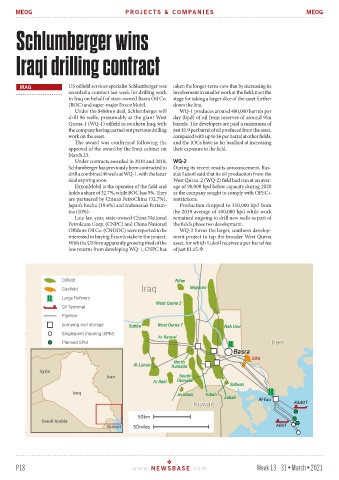

IRAQ US oilfield services specialist Schlumberger was taken the longer-term view that by increasing its

awarded a contract last week for drilling work involvement in smaller work at the field, it set the

in Iraq on behalf of state-owned Basra Oil Co. stage for taking a larger slice of the asset further

(BOC) and super-major ExxonMobil. down the line.

Under the $480mn deal, Schlumberger will WQ-1 produces around 480,000 barrels per

drill 96 wells, presumably at the giant West day (bpd) of oil from reserves of around 9bn

Qurna-1 (WQ-1) oilfield in southern Iraq, with barrels. The developers are paid a maximum of

the company having carried out previous drilling just $1.9 per barrel of oil produced from the asset,

work on the asset. compared with up to $6 per barrel at other fields,

The award was confirmed following the and the IOCs have so far baulked at increasing

approval of the award by the Iraqi cabinet on their exposure to the field.

March 23.

Under contracts awarded in 2010 and 2018, WQ-2

Schlumberger has previously been contracted to During its recent results announcement, Rus-

drill a combined 40 wells at WQ-1, with the latter sia’s Lukoil said that its oil production from the

deal expiring soon. West Qurna-2 (WQ-2) field had run at an aver-

ExxonMobil is the operator of the field and age of 90,000 bpd below capacity during 2020

holds a share of 32.7%, while BOC has 5%. They as the company sought to comply with OPEC+

are partnered by China’s PetroChina (32.7%), restrictions.

Japan’s Itochu (19.6%) and Indonesia’s Pertam- Production dropped to 310,000 bpd from

ina (10%). the 2019 average of 400,000 bpd while work

Late last year, state-owned China National remained ongoing to drill new wells as part of

Petroleum Corp. (CNPC) and China National the field’s phase two development.

Offshore Oil Co. (CNOOC) were reported to be WQ-2 forms the larger, southern develop-

interested in buying Exxon’s stake in the project. ment project to tap the broader West Qurna

With the US firm apparently growing tired of the asset, for which Lukoil receives a per barrel fee

low returns from developing WQ-1, CNPC has of just $1.15.

P18 www. NEWSBASE .com Week 13 31•March•2021