Page 5 - EurOil Week 15 2021

P. 5

EurOil COMMENTARY EurOil

could then be stored for when there is very Hydrogen terminals

little wind. It has also been proposed that Europe’s LNG ter-

minals could also be repurposed for importing

Building a backbone hydrogen, as the EU expects there to be a short-

However, the infrastructure must be in place fall in indigenous supply. But some companies

for a continental hydrogen market to become a are devising plans for all-new dedicated hydro-

reality. gen import facilities.

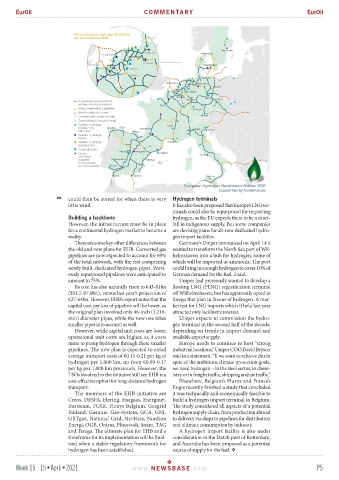

There are some key other differences between Germany’s Uniper announced on April 14 it

the old and new plans for EHB. Converted gas wanted to transform the North Sea port of Wil-

pipelines are now expected to account for 69% helmshaven into a hub for hydrogen, some of

of the total network, with the rest comprising which will be imported as ammonia. The port

newly built, dedicated hydrogen pipes. Previ- could bring in enough hydrogen to cover 10% of

ously repurposed pipelines were anticipated to German demand for the fuel, it said.

amount to 75%. Uniper had previously wanted to develop a

Its cost has also naturally risen to €43-81bn floating LNG (FLNG) regasification terminal

($51.5-97.0bn), versus last year’s projection of off Wilhelmshaven, but has apparently opted to

€27-64bn. However, EHB’s report notes that the forego that plan in favour of hydrogen. A mar-

capital cost per km of pipeline will be lower, as ket test for LNG imports which it held last year

the original plan involved only 48-inch (1,219- attracted only lacklustre interest.

mm) diameter pipes, while the new one takes Uniper expects to commission the hydro-

smaller pipes into account as well. gen terminal in the second half of the decade,

However, while capital unit costs are lower, depending on trends in import demand and

operational unit costs are higher, as it costs available export supply.

more to pump hydrogen through these smaller Europe needs to continue to host “strong

pipelines. The new plan is expected to entail industrial locations,” Uniper COO David Bryson

average transport costs of €0.11-0.21 per kg of said in a statement. “If we want to achieve this in

hydrogen per 1,000 km, up from €0.09-0.17 spite of the ambitious climate protection goals,

per kg per 1,000 km previously. However, the we need hydrogen – in the steel sector, in chem-

TSOs involved in the initiative still see EHB is a istry or in freight traffic, shipping and air traffic.”

cost-effective option for long-distance hydrogen Elsewhere, Belgium’s Fluxys and France’s

transport. Engie recently finished a study that concluded

The members of the EHB initiative are it was technically and economically feasible to

Creos, DESFA, Elering, Enagaas, Energinet, build a hydrogen import terminal in Belgium.

Eustream, FGSZ, Fluxys Belgium, Gasgrid The study considered all aspects of a potential

Finland, Gasunie, Gaz-System, GCA, GNI, hydrogen supply chain, from production abroad

GRTgaz, National Grid, Net4Gas, Nordion to delivery via ships to pipelines for distribution

Energi, OGE, Ontras, Plinovodi, Snam, TAG and ultimate consumption by industry.

and Terega. The ultimate plan for EHB and a A hydrogen import facility is also under

timeframe for its implementation will be final- consideration in the Dutch port of Rotterdam,

ised when a stable regulatory framework for and Australia has been proposed as a potential

hydrogen has been established. source of supply for the fuel.

Week 15 15•April•2021 www. NEWSBASE .com P5