Page 5 - MEOG Week 03 2023

P. 5

MEOG COMMENTARY MEOG

also intends to become self-sufficient in gas development drilling underway.

production. In July, ADNOC Drilling was awarded $2bn

Increased oil output will be complemented worth of deals cover integrated drilling services

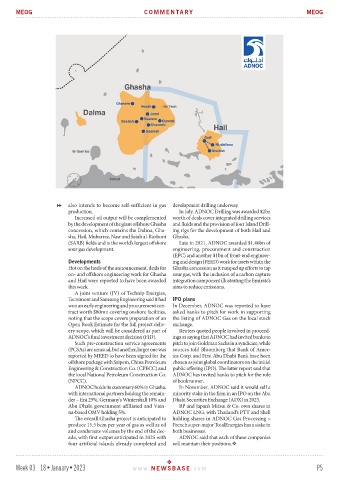

by the development of the giant offshore Ghasha and fluids and the provision of four Island Drill-

concession, which contains the Dalma, Gha- ing rigs for the development of both Hail and

sha, Hail, Mubarraz, Nasr and Satah al-Razboot Ghasha.

(SARB) fields and is the world’s largest offshore Late in 2021, ADNOC awarded $1.46bn of

sour gas development. engineering, procurement and construction

(EPC) and another $1bn of front-end engineer-

Developments ing and design (FEED) work for assets within the

Hot on the heels of the announcement, deals for Ghasha concession as it ramped up efforts to tap

on- and offshore engineering work for Ghasha sour gas, with the inclusion of a carbon capture

and Hail were reported to have been awarded integration component illustrating the Emirate’s

this week. aims to reduce emissions.

A joint venture (JV) of Technip Energies,

Tecnimont and Samsung Engineering said it had IPO plans

won an early engineering and procurement con- In December, ADNOC was reported to have

tract worth $80mn covering onshore facilities, asked banks to pitch for work in supporting

noting that the scope covers preparation of an the listing of ADNOC Gas on the local stock

Open Book Estimate for the full project deliv- exchange.

ery scope, which will be considered as part of Reuters quoted people involved in proceed-

ADNOC’s final investment decision (FID). ings as saying that ADNOC had invited banks to

Such pre-construction service agreements pitch to join Goldman Sachs in a syndicate, while

(PCSAs) are unusual, but another, larger one was sources told Bloomberg that Bank of Amer-

reported by MEED to have been signed for the ica Corp. and First Abu Dhabi Bank have been

offshore package with Saipem, China Petroleum chosen as joint global coordinators on the initial

Engineering & Construction Co. (CPECC) and public offering (IPO). The latter report said that

the local National Petroleum Construction Co. ADNOC has invited banks to pitch for the role

(NPCC). of bookrunner.

ADNOC holds its customary 60% in Ghasha, In November, ADNOC said it would sell a

with international partners holding the remain- minority stake in the firm in an IPO on the Abu

der – Eni 25%, Germany’s Wintershall 10% and Dhabi Securities Exchange (ADX) in 2023.

Abu Dhabi government-affiliated and Vien- BP and Japan’s Mitsui & Co. own shares in

na-based OMV holding 5%. ADNOC LNG, with Thailand’s PTT and Shell

The overall Ghasha project is anticipated to holding shares in ADNOC Gas Processing –

produce 15.5 bcm per year of gas as well as oil French super-major TotalEnergies has a stake in

and condensate volumes by the end of the dec- both businesses.

ade, with first output anticipated in 2025 with ADNOC said that each of these companies

four artificial islands already completed and will maintain their positions.

Week 03 18•January•2023 www. NEWSBASE .com P5