Page 6 - AfrOil Week 39 2022

P. 6

AfrOil INVESTMENT AfrOil

Zenith Energy submits offer

for biggest oilfield in Benin

BENIN CANADA’S Zenith Energy has presented an it will restore and expand the productivity of

offer to Benin for the award of an initial nine- Block-1.

year licence to operate Block-1 in the Sèmè oil- This includes a “rigorous” due diligence pro-

field, the country’s largest. cess, it added.

The block, which covers around 551 square Zenith Energy is listed on the London Stock

km, has estimated recoverable reserves (P2) Exchange (LSE) main market for listed securi-

of 22-28mn barrels of oil and 428bn cubic feet ties (ZEN) and the Euronext Growth Market of

(12.12bn cubic metres) of natural gas. It has the Oslo Stock Exchange (ZENA).

produced a reported 22mn barrels of oil to date,

the Calgary-based company said, though it has

remained idle since 1998.

The historical recovery factor of 22% leaves

significant margin for improvement of the

recovery factor utilising modern completion

techniques, horizontal drilling, and improved

3D seismic, it said.

“We are delighted to have submitted this offer

for what is an extremely exciting opportunity in

Benin, representing the largest and most pro-

spective oilfield in the country,” chief executive

Andrea Cattaneo said. “Block-1 has significant

untapped, independently assessed oil and gas

reserves, a proven history of material oil produc-

tion and existing field infrastructure. These key

qualities make it a potentially highly enriching

addition to our portfolio and fully satisfy the key

criteria defining our growth strategy.”

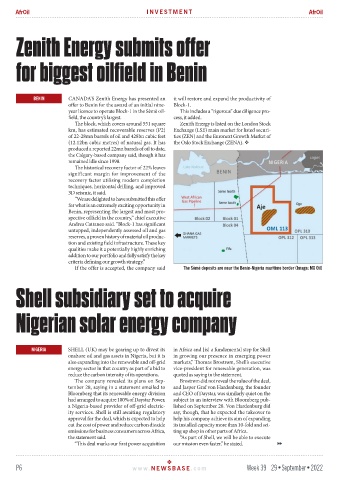

If the offer is accepted, the company said The Sèmè deposits are near the Benin-Nigeria maritime border (Image: MX Oil)

Shell subsidiary set to acquire

Nigerian solar energy company

NIGERIA SHELL (UK) may be gearing up to divest its in Africa and [is] a fundamental step for Shell

onshore oil and gas assets in Nigeria, but it is in growing our presence in emerging power

also expanding into the renewable and off-grid markets,” Thomas Brostrøm, Shell’s executive

energy sector in that country as part of a bid to vice-president for renewable generation, was

reduce the carbon intensity of its operations. quoted as saying in the statement.

The company revealed its plans on Sep- Brostrøm did not reveal the value of the deal,

tember 28, saying in a statement emailed to and Jasper Graf von Hardenburg, the founder

Bloomberg that its renewable energy division and CEO of Daystar, was similarly quiet on the

had arranged to acquire 100% of Daystar Power, subject in an interview with Bloomberg pub-

a Nigeria-based provider of off-grid electric- lished on September 28. Von Hardenburg did

ity services. Shell is still awaiting regulatory say, though, that he expected the takeover to

approval for the deal, which is expected to help help his company achieve its aim of expanding

cut the cost of power and reduce carbon dioxide its installed capacity more than 10-fold and set-

emissions for business consumers across Africa, ting up shop in other parts of Africa.

the statement said. “As part of Shell, we will be able to execute

“This deal marks our first power acquisition our mission even faster,” he stated.

P6 www. NEWSBASE .com Week 39 29•September•2022