Page 7 - FSUOGM Week 17 2022

P. 7

FSUOGM COMMENTARY FSUOGM

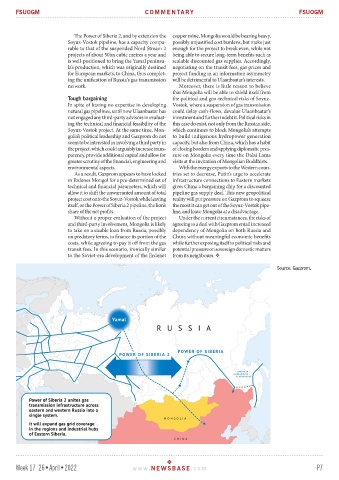

The Power of Siberia 2, and by extension the copper mine, Mongolia would be bearing heavy,

Soyuz-Vostok pipeline, has a capacity compa- possibly unjustified cost burdens, but make just

rable to that of the suspended Nord Stream 2 enough for the project to break even, while not

projects of about 50bn cubic metres a year and being able to secure long-term benefits such as

is well-positioned to bring the Yamal peninsu- scalable discounted gas supplies. Accordingly,

la’s production, which was originally destined negotiating on the transit fees, gas prices and

for European markets, to China, thus complet- project funding in an information asymmetry

ing the unification of Russia's gas transmission will be detrimental to Ulaanbaatar’s interests.

network. Moreover, there is little reason to believe

that Mongolia will be able to shield itself from

Tough bargaining the political and geo-technical risks of Soyuz-

In spite of having no expertise in developing Vostok, where a suspension of gas transmission

natural gas pipelines, until now Ulaanbaatar has could delay cash-flows, devalue Ulaanbaatar’s

not engaged any third-party advisors in evaluat- investment and further indebt it. Political risks in

ing the technical and financial feasibility of the this case do exist, not only from the Russian side,

Soyuz-Vostok project. At the same time, Mon- which continues to block Mongolia’s attempts

golia’s political leadership and Gazprom do not to build indigenous hydropower generation

seem to be interested in involving a third party in capacity, but also from China, which has a habit

the project, which could arguably increase trans- of closing borders and applying diplomatic pres-

parency, provide additional capital and allow for sure on Mongolia every time the Dalai Lama

greater scrutiny of the financial, engineering and visits at the invitation of Mongolian Buddhists.

environmental aspects. With the energy exports to the Western coun-

As a result, Gazprom appears to have locked tries set to decrease, Putin’s urge to accelerate

in Erdenes Mongol for a pre-determined set of infrastructure connections to Eastern markets

technical and financial parameters, which will gives China a bargaining chip for a discounted

allow it to shift the unwarranted amount of total pipeline gas supply deal. This new geopolitical

project cost onto the Soyuz-Vostok while leaving reality will put pressure on Gazprom to squeeze

itself, or the Power of Siberia 2 pipeline, the lion’s the most it can get out of the Soyuz-Vostok pipe-

share of the net profits. line, and leave Mongolia at a disadvantage.

Without a proper evaluation of the project Under the current circumstances, the risks of

and third-party involvement, Mongolia is likely agreeing to a deal with Gazprom entail increased

to take on a sizable loan from Russia, possibly dependency of Mongolia on both Russia and

on predatory terms, to finance its portion of the China without meaningful economic benefits

costs, while agreeing to pay it off from the gas while further exposing itself to political risks and

transit fees. In this scenario, ironically similar potential pressure on sovereign domestic matters

to the Soviet-era development of the Erdenet from its neighbours.

Source: Gazprom.

Week 17 26•April•2022 www. NEWSBASE .com P7