Page 13 - LatAmOil Week 21 2022

P. 13

LatAmOil BRAZIL LatAmOil

If the first phase of expansion proves to be suc- FPSO as well as a gas pipeline to transport the

cessful, the companies may decide to double output to shore.

investment in the project during the second Bacalhau is the first oilfield in Brazil not to be

phase, one of Reuters’ sources said. Equinor’s developed by state-owned Petrobras. ExxonMo-

spokesperson did not comment directly on this bil owns a 40% stake in the field, while Equinor

statement but said the deciding factor would be has 40% and serves as operator.

whether or not the field could produce enough Petrogal Brasil holds the remaining 20% of

oil to justify the implementation of a second equity.

Petrobras says it may need to import more

LNG to make up for Bolivian supply cuts

BRAZIL’S national oil company (NOC) Petro- Media reported on May 23, citing trade data,

bras has said it may need to import more LNG that YPFB had also reduced shipments in the

due to an unexpected cut in shipments of natu- month of April.

ral gas from Bolivia. Preliminary figures based on data from Bra-

Petrobras noted in a statement that supply zil’s National Agency of Petroleum, Natural Gas

concerns had arisen as a consequence of the and Biofuels (ANP) show that the Bolivian NOC

fact that YPFB, the Bolivian NOC, had reduced sent only 7.5 mcm per day of gas in the week of

the volume of gas flowing to Brazil by 30% this April 3-9, down from an average of 19 mcm per

month. YPFB is supposed to be delivering 20mn day in the preceding weeks. This is equivalent to

cubic metres per day of gas under the terms of just 37.5% of the agreed contractual volume of

its contract with Petrobras, the statement said, 20 mcm per day.

but it has only been delivering 14 mcm per day. According to Argus, the most recent avail-

The cuts put the Brazilian company in a able weekly figure indicates that Bolivian gas

position of needing to find another way to shipments amounted to 16.7 mcm per day in the

cover domestic gas demand, the statement week of May 9-15. This is equivalent to 83.5% of

said. “This 30% decrease was not foreseen and the total contracted volume of 20 mcm per day.

implies the need for additional imports of LNG Petrobras has not speculated on the reasons

to meet Petrobras’ commitments of gas supply,” for the reduction in Bolivian supplies.

it commented. Argus cited two possible reasons, though,

Petrobras also stated that it intended to noting on the one hand that Bolivia had seen

respond to YPFB’s unanticipated reductions pipeline flows drop this year as a result of

with “fitting actions” but did not say what these declining upstream production and on the other

might entail. hand that Bolivia might be sending more gas to

This month’s supply cuts are worrisome, as Argentina under a new export agreement with

Bolivian gas deliveries of 20 mcm per day cov- Integración Energética SA (IEASA), a state-

ered 22% of Brazilian gas demand in 2021. How- owned oil, gas and power company formerly

ever, they are not the first of their kind. Argus known as Enarsa.

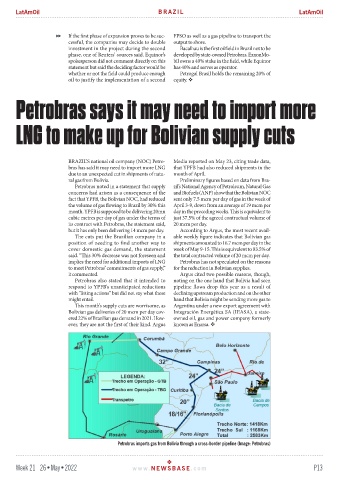

Petrobras imports gas from Bolivia through a cross-border pipeline (Image: Petrobras)

Week 21 26•May•2022 www. NEWSBASE .com P13