Page 5 - MEOG Week 47 2021

P. 5

MEOG COMMENTARY MEOG

Total optimism Petronas this week reporting that drilling had

Cause for optimism came by way of the mega- begun on a new well.

deal finalised between Baghdad and France’s Meanwhile, state-owned Iraqi Drilling Co.

TotalEnergies in September. (IDC) is collaborating with various international

This foresees an investment of up to $27bn partners to drill wells at the Missan oilfield clus-

over the 25-year contract and will entail raised ter (150 wells), the giant Zubair field (37) and

oil production, gas capture and utilisation, solar Nasiriyah (20).

PV and the development of the stalled Common Perhaps the most gratifying for Baghdad

Seawater Supply Facility (CSSF) which Exxon- is that IDC secured a deal to drill 30 wells for

Mobil had been overseeing. BP, PetroChina and Basra Oil Co. (BOC) at the

The latter will likely play a far larger role in country’s main workhorse asset, Rumaila, which

Iraq’s ability to achieve its goal than the 125,000 has been producing around 1.4mn bpd in 2021.

bpd production increase TotalEnergies is The companies are partners in the Rumaila

expected to bring to the Ratawi field. Operating Organization (ROO), which remains

While reducing flaring and increasing in discussions with the MoO to determine short-

improving electricity supplies are key strate- term production targets.

gic ambitions of the Iraqi authorities, the main The field’s plateau level was negotiated down-

boon for Baghdad was that it attracted such a ward from 2.85mn bpd to 2.1mn bpd in 2014, a

significant commitment from a premier global figure which BP said it was still working towards

company despite other firms’ efforts to leave and last year.

amid growing pressure for IOCs to embrace the In an interview with Iraq Oil Report this

energy transition. week, ROO director Hussein Abdul-Kadhim

More than 90% of state receipts coming from Hussein said: “There is a possibility that produc-

the sale of crude oil and Iraq must continue to tion levels will fall and then rise. We expect pro-

prioritise oilfield development while charter- duction to reach 1.65mn bpd in 2025.”

ing its own course towards a cleaner future. As However, there remain questions over

it becomes trickier for field developers to access whether Iraq can achieve its 3mn bpd output

international funding sources, Baghdad is incen- boost. Speaking to MEOG, Ian Simm, principal

tivised to ramp up drilling activities as quickly advisor at consultancy IGM Energy, said: “Iraq

as possible. certainly has the potential to increase produc-

With time of the essence, there are numer- tion significantly. Its fields are world class and

ous campaigns under way at other assets across reserve figures could be due an upgrade.”

the country that will add incremental crude He added: “Considering all of the current

volumes. plans, we estimate that Iraq could raise oil pro-

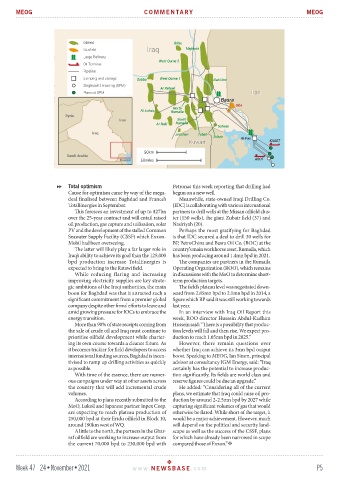

According to plans recently submitted to the duction by around 2-2.5mn bpd by 2027 while

MoO, Lukoil and Japanese partner Inpex Corp. capturing significant volumes of gas that would

are expecting to reach plateau production of otherwise be flared. While short of the target, it

250,000 bpd at their Eridu oilfield in Block 10, would be a major achievement. However, much

around 190km west of WQ. will depend on the political and security land-

A little to the north, the partners in the Ghar- scape as well as the success of the CSSF, plans

raf oilfield are working to increase output from for which have already been narrowed in scope

the current 70,000 bpd to 230,000 bpd with compared those of Exxon.”

Week 47 24•November•2021 www. NEWSBASE .com P5