Page 5 - EurOil Week 44 2021

P. 5

EurOil COMMENTARY EurOil

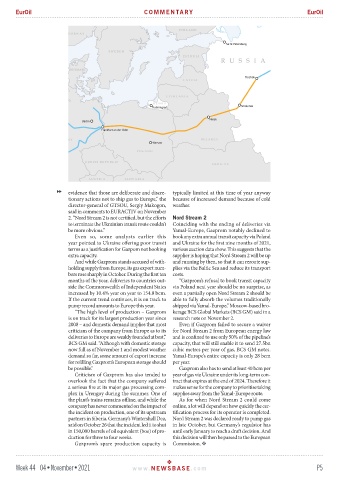

evidence that those are deliberate and discre- typically limited at this time of year anyway

tionary actions not to ship gas to Europe,” the because of increased demand because of cold

director-general of GTSOU, Sergiy Makogon, weather.

said in comments to EURACTIV on November

2. “Nord Stream 2 is not certified, but the efforts Nord Stream 2

to terminate the Ukrainian transit route couldn’t Coinciding with the ending of deliveries via

be more obvious.” Yamal-Europe, Gazprom notably declined to

Even so, some analysts earlier this book any extra annual transit capacity via Poland

year pointed to Ukraine offering poor transit and Ukraine for the first nine months of 2021,

terms as a justification for Gazpom not booking various auction data show. This suggests that the

extra capacity. supplier is hoping that Nord Stream 2 will be up

And while Gazprom stands accused of with- and running by then, so that it can reroute sup-

holding supply from Europe, its gas export num- plies via the Baltic Sea and reduce its transport

bers rose sharply in October. During the first ten costs.

months of the year, deliveries to countries out- “Gazprom’s refusal to book transit capacity

side the Commonwealth of Independent States via Poland next year should be no surprise, as

increased by 10.4% year on year to 154.8 bcm. even a partially open Nord Stream 2 should be

If the current trend continues, it is on track to able to fully absorb the volumes traditionally

pump record amounts to Europe this year. shipped via Yamal-Europe,” Moscow-based bro-

“The high level of production – Gazprom kerage BCS Global Markets (BCS GM) said in a

is on track for its largest production year since research note on November 2.

2008 – and domestic demand implies that most Even if Gazprom failed to secure a waiver

criticism of the company from Europe as to its for Nord Stream 2 from European energy law

deliveries to Europe are weakly founded at best,” and is confined to use only 50% of the pipeline’s

BCS GM said. “Although with domestic storage capacity, that will still enable it to send 27.5bn

now full as of November 1 and modest weather cubic metres per year of gas, BCS GM notes.

demand so far, some amount of export increase Yamal-Europe’s entire capacity is only 28 bcm

for refilling Gazprom’s European storage should per year.

be possible.” Gazprom also has to send at least 40 bcm per

Criticism of Gazprom has also tended to year of gas via Ukraine under its long-term con-

overlook the fact that the company suffered tract that expires at the end of 2024. Therefore it

a serious fire at its major gas processing com- makes sense for the company to prioritise taking

plex in Urengoy during the summer. One of supplies away from the Yamal-Europe route.

the plant’s trains remains offline, and while the As for when Nord Stream 2 could come

company has never commented on the impact of online, a lot will depend on how quickly the cer-

the incident on production, one of its upstream tification process for its operator is completed.

partners in Siberia, Germany’s Wintershall Dea, Nord Stream 2 was declared ready to pump gas

said on October 26 that the incident led it to shut in late October, but Germany’s regulator has

in 150,000 barrels of oil equivalent (boe) of pro- until early January to reach a draft decision. And

duction for three to four weeks. this decision will then be passed to the European

Gazprom’s spare production capacity is Commission.

Week 44 04•November•2021 www. NEWSBASE .com P5