Page 5 - MEOG Week 23 2022

P. 5

MEOG COMMENTARY MEOG

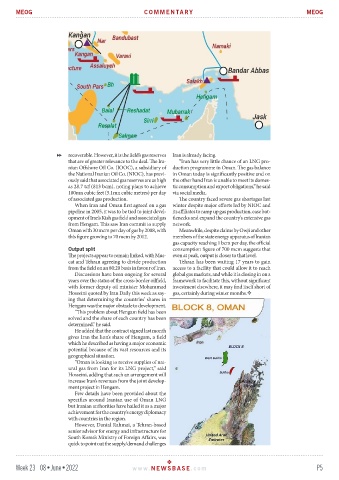

recoverable. However, it is the field’s gas reserves Iran is already facing.

that are of greater relevance to the deal. The Ira- “Iran has very little chance of an LNG pro-

nian Offshore Oil Co. (IOOC), a subsidiary of duction programme in Oman. The gas balance

the National Iranian Oil Co. (NIOC), has previ- in Oman today is significantly positive and on

ously said that associated gas reserves are as high the other hand Iran is unable to meet its domes-

as 28.7 tcf (813 bcm), noting plans to achieve tic consumption and export obligations,” he said

180mn cubic feet (5.1mn cubic metres) per day via social media.

of associated gas production. The country faced severe gas shortages last

When Iran and Oman first agreed on a gas winter despite major efforts led by NIOC and

pipeline in 2005, it was to be tied to joint devel- its affiliates to ramp up gas production, ease bot-

opment of Iran’s Kish gas field and associated gas tlenecks and expand the country’s extensive gas

from Hengam. This saw Iran commit to supply network.

Oman with 30 mcm per day of gas by 2008, with Meanwhile, despite claims by Owji and other

this figure growing to 70 mcm by 2012. members of the state energy apparatus of Iranian

gas capacity reaching 1 bcm per day, the official

Output split consumption figure of 700 mcm suggests that

The projects appear to remain linked, with Mus- even at peak, output is closer to that level.

cat and Tehran agreeing to divide production Tehran has been waiting 17 years to gain

from the field on an 80:20 basis in favour of Iran. access to a facility that could allow it to reach

Discussions have been ongoing for several global gas markets, and while it is closing in on a

years over the status of the cross-border oilfield, framework to facilitate this, without significant

with former deputy oil minister Mohammad investment elsewhere, it may find itself short of

Hosseini quoted by Iran Daily this week as say- gas, certainly during winter months.

ing that determining the countries’ shares in

Hengam was the major obstacle to development.

“This problem about Hengam field has been

solved and the share of each country has been

determined,” he said.

He added that the contract signed last month

gives Iran the lion’s share of Hengam, a field

which he described as having a major economic

potential because of its vast resources and its

geographical situation.

“Oman is looking to receive supplies of nat-

ural gas from Iran for its LNG project,” said

Hosseini, adding that such an arrangement will

increase Iran’s revenues from the joint develop-

ment project in Hengam.

Few details have been provided about the

specifics around Iranian use of Oman LNG

but Iranian authorities have hailed it as a major

achievement for the country’s energy diplomacy

with countries in the region.

However, Danial Rahmat, a Tehran-based

senior advisor for energy and infrastructure for

South Korea’s Ministry of Foreign Affairs, was

quick to point out the supply/demand challenges

Week 23 08•June•2022 www. NEWSBASE .com P5