Page 5 - EurOil Week 09 2021

P. 5

EurOil COMMENTARY EurOil

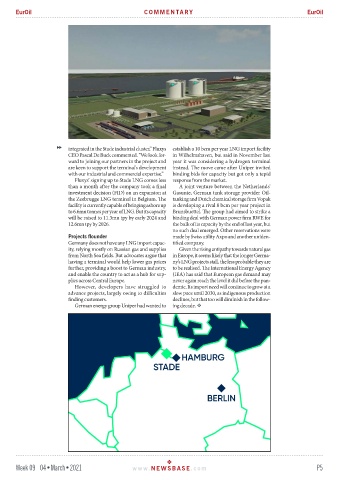

integrated in the Stade industrial cluster,” Fluxys establish a 10 bcm per year LNG import facility

CEO Pascal De Buck commented. “We look for- in Wilhelmshaven, but said in November last

ward to joining our partners in the project and year it was considering a hydrogen terminal

are keen to support the terminal’s development instead. The move came after Uniper invited

with our industrial and commercial expertise.” binding bids for capacity but got only a tepid

Fluxys’ signing up to Stade LNG comes less response from the market.

than a month after the company took a final A joint venture between the Netherlands’

investment decision (FID) on an expansion at Gasunie, German tank storage provider Oil-

the Zeebrugge LNG terminal in Belgium. The tanking and Dutch chemical storage firm Vopak

facility is currently capable of bringing ashore up is developing a rival 8 bcm per year project in

to 6.6mn tonnes per year of LNG. But its capacity Brunsbuettel. The group had aimed to strike a

will be raised to 11.3mn tpy by early 2024 and binding deal with German power firm RWE for

12.6mn tpy by 2026. the bulk of its capacity by the end of last year, but

no such deal emerged. Other reservations were

Projects flounder made by Swiss utility Axpo and another uniden-

Germany does not have any LNG import capac- tified company.

ity, relying mostly on Russian gas and supplies Given the rising antipathy towards natural gas

from North Sea fields. But advocates argue that in Europe, it seems likely that the longer Germa-

having a terminal would help lower gas prices ny’s LNG projects stall, the less probable they are

further, providing a boost to German industry, to be realised. The International Energy Agency

and enable the country to act as a hub for sup- (IEA) has said that European gas demand may

plies across Central Europe. never again reach the level it did before the pan-

However, developers have struggled to demic. Its import need will continue to grow at a

advance projects, largely owing to difficulties slow pace until 2030, as indigenous production

finding customers. declines, but that too will diminish in the follow-

German energy group Uniper had wanted to ing decade.

Week 09 04•March•2021 www. NEWSBASE .com P5