Page 7 - AfrOil Week 38 2022

P. 7

AfrOil PIPELINES & TRANSPORT AfrOil

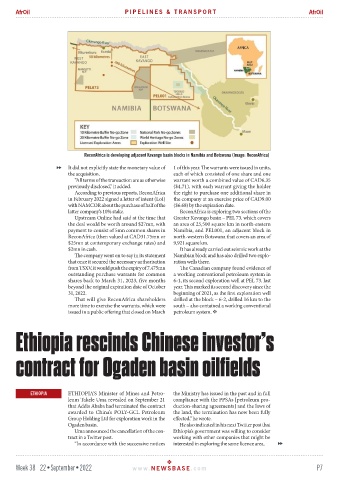

ReconAfrica is developing adjacent Kavango basin blocks in Namibia and Botswana (Image: ReconAfrica)

It did not explicitly state the monetary value of 1 of this year. The warrants were issued in units,

the acquisition. each of which consisted of one share and one

“All terms of the transaction are as otherwise warrant worth a combined value of CAD6.35

previously disclosed,” it added. ($4.71), with each warrant giving the holder

According to previous reports, ReconAfrica the right to purchase one additional share in

in February 2022 signed a letter of intent (LoI) the company at an exercise price of CAD9.00

with NAMCOR about the purchase of half of the ($6.68) by the expiration date.

latter company’s 10% stake. ReconAfrica is exploring two sections of the

Upstream Online had said at the time that Greater Kavango basin – PEL 73, which covers

the deal would be worth around $27mn, with an area of 25,500 square km in north-eastern

payment to consist of 5mn common shares in Namibia, and PEL001, an adjacent block in

ReconAfrica (then valued at CAD31.75mn or north-western Botswana that covers an area of

$25mn at contemporary exchange rates) and 9,921 square km.

$2mn in cash. It has already carried out seismic work at the

The company went on to say in its statement Namibian block and has also drilled two explo-

that once it secured the necessary authorisation ration wells there.

from TSXV, it would push the expiry of 7.475mn The Canadian company found evidence of

outstanding purchase warrants for common a working conventional petroleum system in

shares back to March 31, 2023, five months 6-1, its second exploration well at PEL 73, last

beyond the original expiration date of October year. This marked its second discovery since the

31, 2022. beginning of 2021, as the first exploration well

That will give ReconAfrica shareholders drilled at the block – 6-2, drilled 16 km to the

more time to exercise the warrants, which were south – also contained a working conventional

issued in a public offering that closed on March petroleum system.

Ethiopia rescinds Chinese investor’s

contract for Ogaden basin oilfields

ETHIOPIA ETHIOPIA’S Minister of Mines and Petro- the Ministry has issued in the past and in full

leum Takele Uma revealed on September 21 compliance with the PPSAs [petroleum pro-

that Addis Ababa had terminated the contract duction-sharing agreements] and the laws of

awarded to China’s POLY-GCL Petroleum the land, the termination has now been fully

Group Holding Ltd for exploration work in the effected,” he wrote.

Ogaden basin. He also indicated in his next Twitter post that

Uma announced the cancellation of the con- Ethiopia’s government was willing to consider

tract in a Twitter post. working with other companies that might be

“In accordance with the successive notices interested in exploring the same licence area.

Week 38 22•September•2022 www. NEWSBASE .com P7